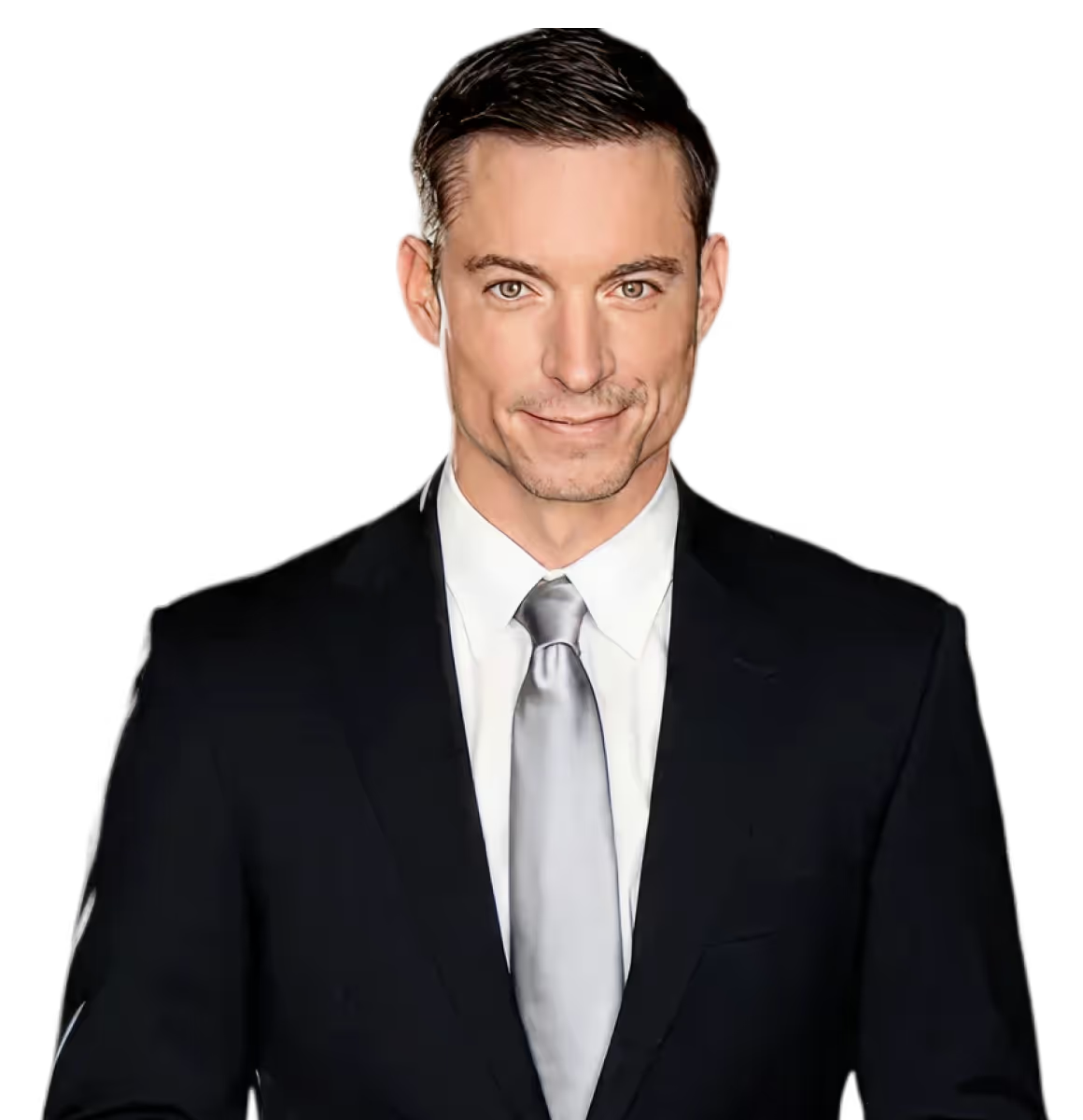

Jesse brings a holistic, client-specific approach to his role: creating, monitoring, and adjusting personalized plans to support each client’s unique financial goals.

Jesse began his career at Fidelity Investments as a Workplace Planning Consultant, where he specialized in retirement planning and investment guidance within 401(k) accounts. Today, he leverages that foundation to deliver thoughtful strategies that integrate long-term planning, disciplined investing, and proactive client service.

Outside of work, Jesse enjoys time with his family, playing golf – he was a member of the 2004 NCAA National Championship Golf Team – barbecuing Wagyu beef from his family’s boutique cattle ranch, and volunteering with local charities such as Sleep in Heavenly Peace. A fifth-generation cattle rancher, Jesse values hard work, tradition, and community – principles that guide both his personal and professional life.

Start by scheduling a discovery call. Think of it as a mutual interview, not a sales pitch. We’ll explore your goals, assets, and financial vision. If we’re the right fit, our Concierge Team seamlessly handles setup and transfers, ensuring a smooth, tax-efficient transition from day one.

Farther advisors act in your best interest and are fiduciaries. We’ve eliminated commissions to remove conflicts and use a simple, transparent fee structure. Our growth depends directly on your success — we thrive only when your wealth does.

Our technology amplifies — not replaces — human expertise. The platform manages daily precision tasks, freeing your advisor to focus on strategy and nuance. This blend of advanced automation and human insight ensures your wealth benefits from both innovation and personal guidance.

Farther’s platform uses advanced encryption, continuous monitoring, and a proprietary vault architecture engineered for maximum data integrity. Backed by leading global tech investors like Alphabet’s CapitalG, our systems are designed and vetted to keep your wealth safe.

Farther acts as your wealth’s central hub. Our unified platform brings all your accounts together, while your dedicated advisor orchestrates your investment, tax, and estate strategies. The result is a seamless, proactive, and fully coordinated approach to managing every part of your financial life.