Explore the benefits and risks of 401k loans, along with key considerations to make informed financial decisions.

Your 401(k) might look like the perfect solution when you need cash fast. After all, they're your funds - so why not borrow money from yourself? Many people think exactly the same way: research from the Employee Benefit Research Institute shows that about 13% of workers have taken loans from their 401(k) accounts.

But before you tap into tomorrow's retirement savings to solve today's money needs, there's a lot to consider. Whether you're facing an emergency, eyeing a major purchase, or trying to tackle debt, borrowing from your 401(k) is a bigger decision than it might seem.

Let's explore when taking a 401(k) loan might make sense - and when it could come back to haunt you later.

This financial option lets you borrow from your retirement savings account. You take part of your vested balance and agree to pay it back with interest, often through payroll deductions. The loan amount is usually limited to $50,000 or half of your vested balance—whichever is less.

Unlike a withdrawal, this option avoids taxes and penalties if repaid in full on time. Most loans must be repaid within five years unless used for specific things like buying a primary residence.

Missed payments may turn the unpaid balance into taxable income plus IRS penalties.

Borrowing from yourself might seem simple—but it can affect long-term growth.

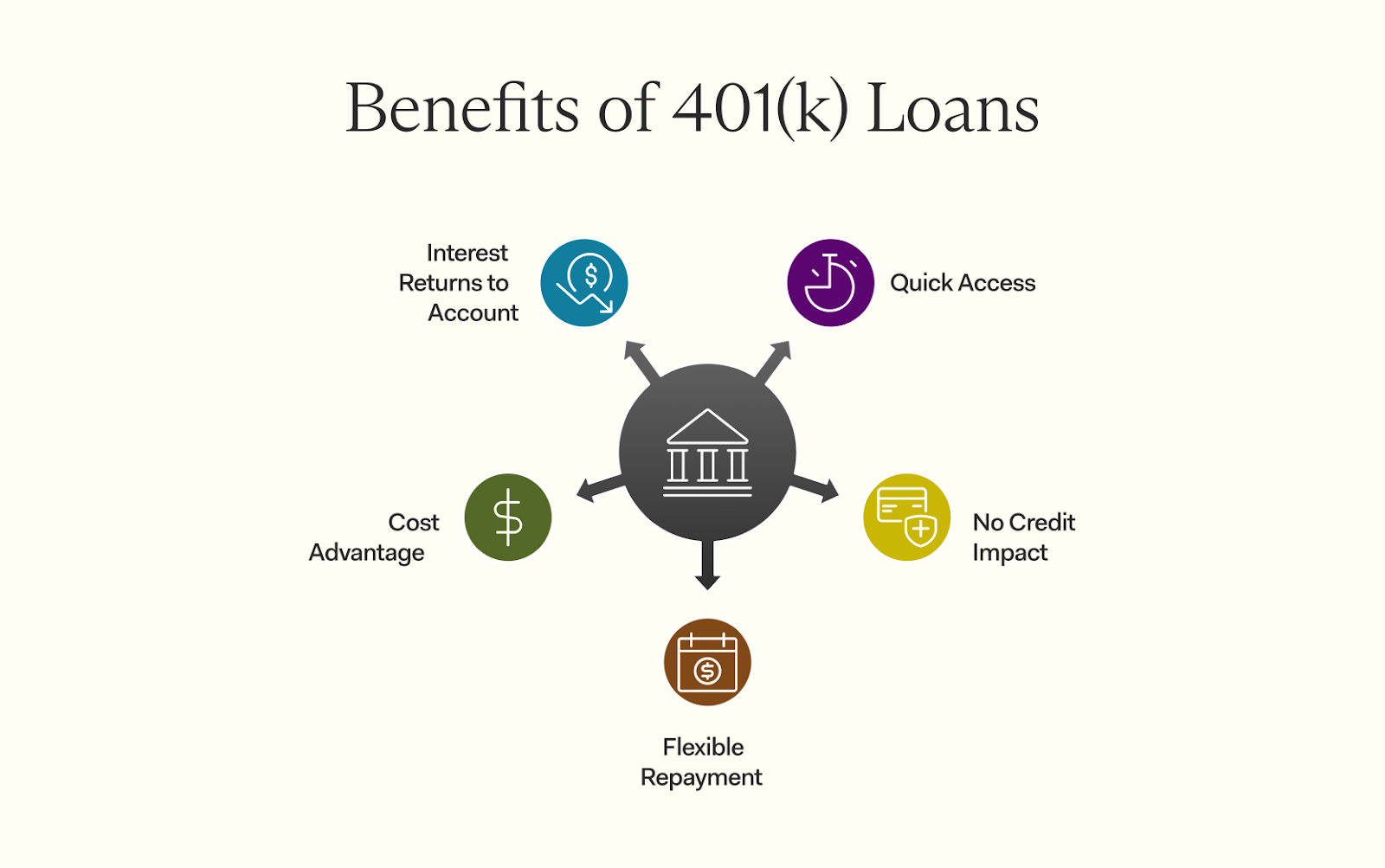

A 401(k) loan can provide quick access to your own money without the need for a credit check. It's often cheaper than other borrowing options, making it worth considering in certain situations.

Speed and Convenience

These loans are quick and simple to obtain. Most plans don't require a credit check, so there's less paperwork. You can often borrow the money within days after approval. The plan administrator handles the process, saving you time.

Loan amounts are based on your vested account balance, making it easy to know how much you can borrow. No waiting for long approvals like with personal loans or home equity lines of credit—your funds come directly from your retirement account.

Taking a 401(k) loan doesn't affect your credit score. The plan loan isn't reported to credit bureaus, so it won't increase or decrease your score. Unlike personal loans or credit card debt, there's no hard inquiry on your credit report.

This makes it an ideal option for those worried about their financial history.

Missed payments also don't show up on your record. However, failing to repay the loan in full may have tax consequences. Unpaid amounts could be considered taxable income and subject to penalties if withdrawn early before age 59½.

You can repay a 401(k) loan through automatic paycheck deductions, making it simple to stay on track. Most plans allow repayment over five years, though buying a home may extend this period.

If you leave your job, the unpaid balance might be due sooner—typically by the tax filing deadline (including extensions) for the year you left the job or immediately upon termination. Failing to pay back the loan can lead to income tax and penalties for early withdrawal.

401(k) loans often have lower interest rates than personal loans or credit cards. The interest you pay goes back into your retirement account, not to a bank or lender. There are no origination fees or penalties tied to the loan process.

Unlike other loan options, borrowing from your 401(k) avoids paying after-tax money twice on repayment and interest. This can save significant costs over time while still helping meet immediate financial needs.

The interest on your 401(k) loan isn't lost. Instead of paying a bank, you pay yourself. Loan interest returns to your retirement plan account as part of the repayment process. This method helps rebuild your funds while covering the loan balance.

Unlike traditional loans, it benefits your future savings. The rate of return may still grow over time despite borrowing from the account. This approach can lessen financial stress for participants needing access to their vested account balance quickly without sacrificing every potential growth opportunity.

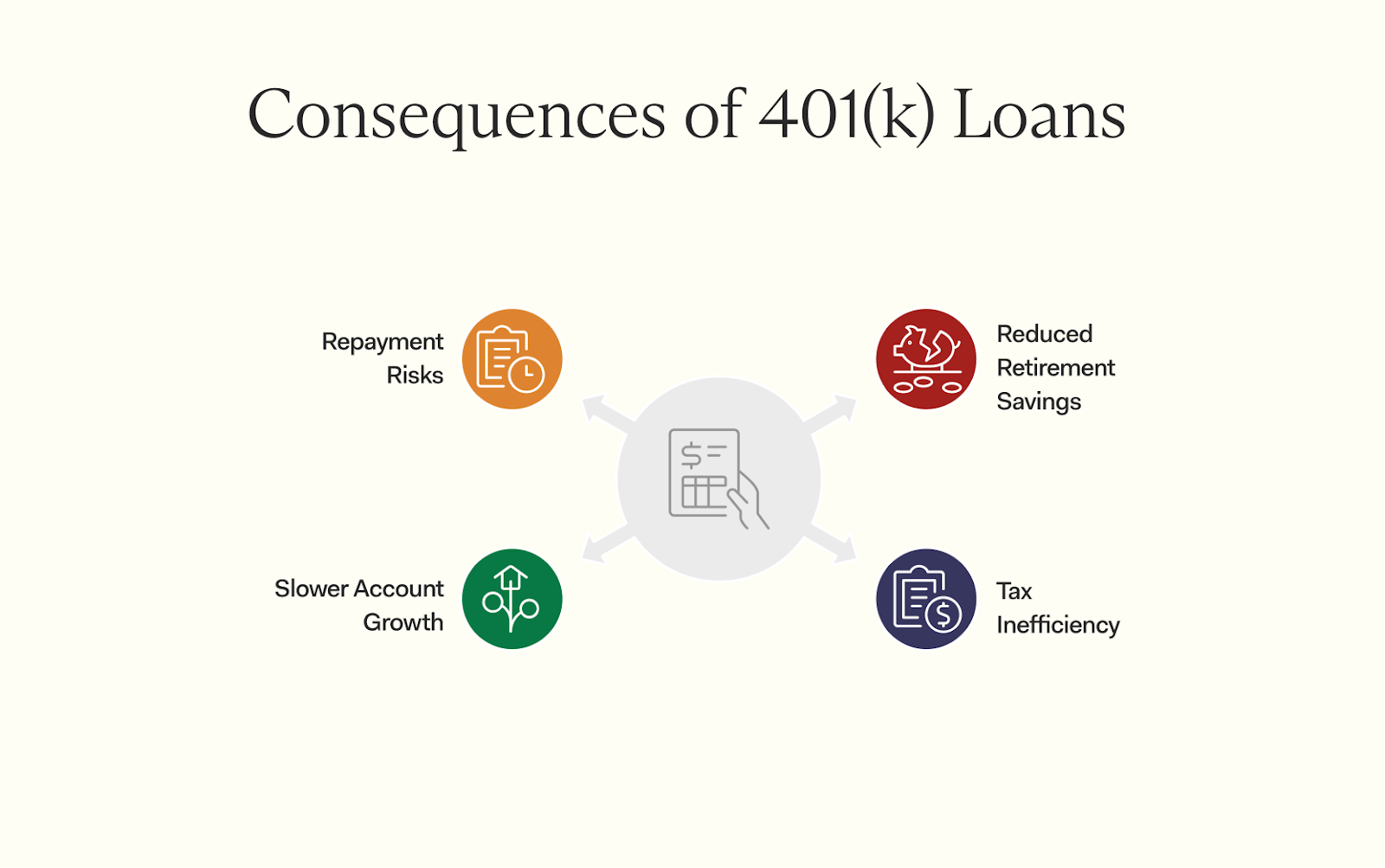

Borrowing from your retirement plan can affect your future savings. It also comes with risks and financial drawbacks that might outweigh the benefits.

Borrowing from your 401(k) reduces the amount invested in retirement funds, leading to diminished growth over time due to missed compounding benefits. Even if the loan is repaid, missed retirement savings can affect your future financial goals.

Repaying the loan requires after-tax dollars, which further decreases your savings. If payments are missed or delayed, unpaid loans could be treated as a taxable distribution. Over time, these challenges can result in having less money available for your retirement needs.

A 401(k) loan can lead to tax troubles. Loan payments are made with after-tax dollars. This means you pay taxes on that money twice—once during repayment and later during withdrawal in retirement.

If the loan isn't repaid on time, it's treated as a taxable distribution. You might face federal income tax and an early withdrawal penalty if you're under 59½. This could cost thousands extra over time.

A 401(k) loan reduces your invested balance. This means less money grows through compounding over time. Even though the loan goes back into your account with interest, growth slows because the borrowed amount isn't earning market returns.

If you stop contributing during repayment, it further affects long-term savings. Missed contributions mean skipped employer matches, which are free money for retirement. The impact becomes more noticeable if market gains outpace the loan's interest rate.

Leaving your job with an outstanding 401(k) loan typically requires prompt repayment. Many plans mandate that the remaining loan balance be repaid by the tax filing deadline (including extensions) for the year of your departure or immediately upon termination.

If you cannot repay the loan within this timeframe, the outstanding balance is treated as a taxable distribution, subject to income tax and, if you're under age 59½, a 10% early withdrawal penalty. This adds extra costs while losing retirement savings growth.

Given these potential financial consequences, it's advisable to explore alternatives such as emergency savings or personal loans before borrowing from your 401(k).

Sometimes life demands quick access to funds. A 401(k) loan might help in certain situations, but it's not always the best choice—consider your options carefully.

Money from your retirement account can provide quick funds during emergencies. This option often offers a lower cost than high-interest credit cards or installment loans. You can take up to 50% of the vested account balance, with a maximum loan amount of $50,000.

The loan repayment period usually extends up to five years. Payments go back into your account—plus interest you pay yourself—helping limit long-term impact on retirement savings.

Only consider this if other options like emergency savings fall short.

Using a 401(k) loan to eliminate high-interest debt can save money. Credit card rates often reach 20% or more, while plan loans usually charge much less interest. Since the interest paid goes back into your account, it benefits you instead of lenders.

You also avoid damaging your credit score since the loan doesn't impact it.

This option works well if monthly payments on debts feel overwhelming. Repaying one loan at lower rates is simpler than juggling many accounts. Be sure to stick to your repayment schedule—unpaid amounts may be counted as taxable income if defaulted or not repaid after leaving a job.

A 401(k) loan can help secure a primary residence. The loan must be repaid within the set loan period, often five years, unless it qualifies for extended terms.

Interest paid goes back into your account, unlike traditional loans.

Leaving your job comes with risks. The unpaid balance may be due upon withdrawal and counted as taxable income. Weighing this option against alternatives like home equity loans or savings is critical before borrowing from retirement funds.

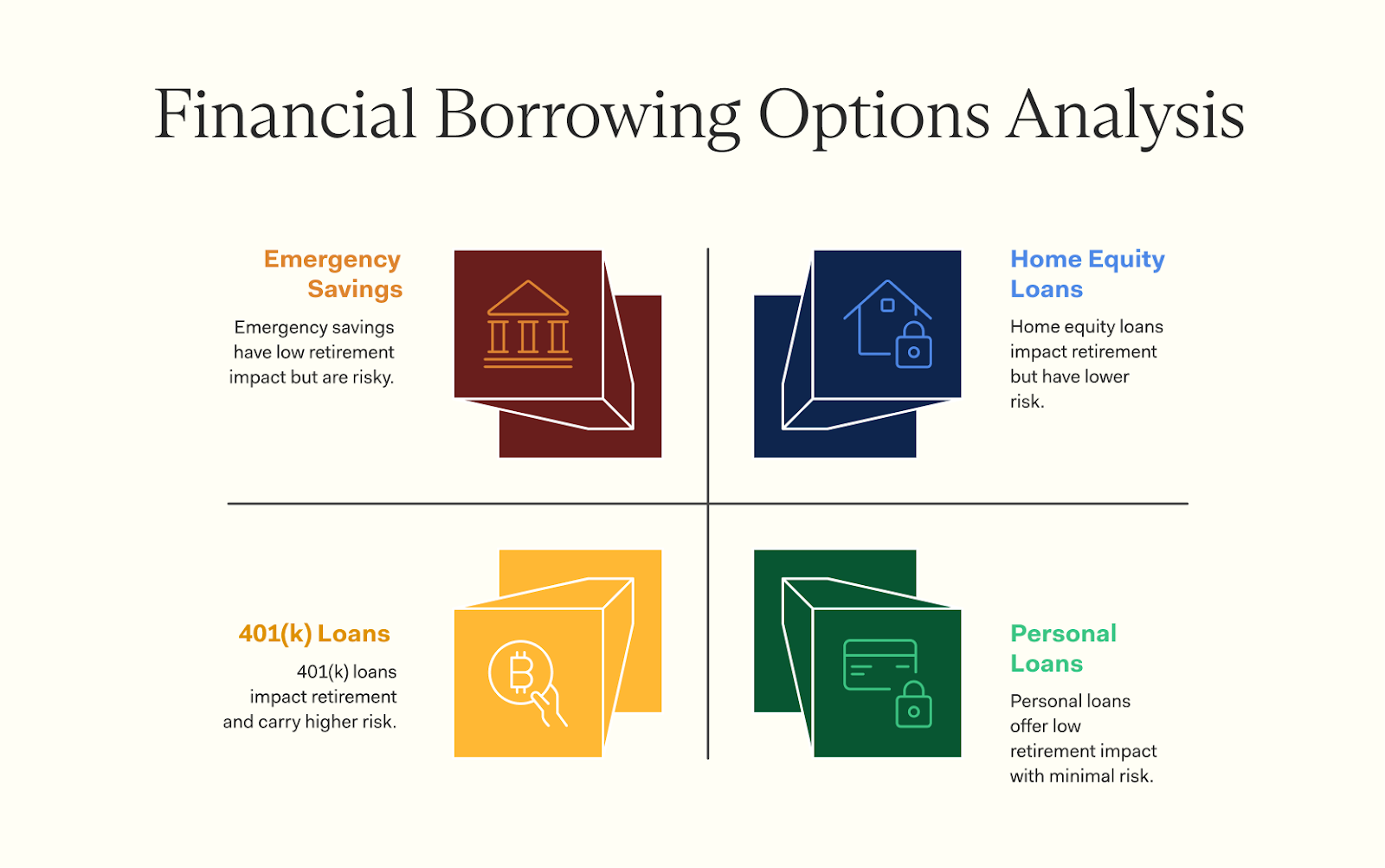

Several borrowing options might work better than tapping your retirement account, depending on your situation. Consider choices that protect your retirement savings while meeting immediate needs.

These loans can help cover unexpected costs or consolidate debt. Unlike 401(k) loans, they don't impact retirement savings. Personal loans come from banks, credit unions, or online lenders and offer fixed payments over time.

Approval depends on credit scores and income but doesn't tie to your retirement account.

Interest rates may be higher than a home equity line of credit but less risky than early withdrawals from your 401(k). Repay the loan on time to avoid late fees that hurt your credit score.

Personal loans make sense if you need money without tapping into retirement funds.

These options let you borrow against your home's value. They often have lower interest rates compared to personal loans or credit cards. You can use them for large expenses like paying off high-interest debt or making a down payment on a home.

With these options, your house serves as collateral. Failing to repay may put your property at risk. Interest payments are made with after-tax dollars and aren't always tax-deductible anymore under current tax laws unless used for home improvements.

This borrowing method works if you need funds quickly and own significant equity in your house.

Your rainy-day fund can provide a quick solution for financial needs. Unlike 401(k) loans, withdrawals from these funds don't affect retirement plans or future growth. Using emergency savings avoids tax penalties and doesn't require repayment like loans generally do.

This option works best if the amount needed is less than your saved balance. It's usually faster and simpler than borrowing from retirement accounts. Next, consider personal loans as another alternative.

Taking a loan from your 401(k) can provide quick access to cash, but it also comes with risks that could impact your retirement savings.

A Farther financial advisor can help you evaluate your options, understand the long-term effects, and explore alternative solutions.

Make a smart financial decision—talk to an advisor today.

Weighing the pros and cons of 401(k) loans can help you make a smarter decision. The advantages are appealing: quick access to your money, no credit check, and interest that goes back into your own pocket. But the drawbacks are serious: you'll reduce your retirement savings and could face unexpected taxes if things don't go as planned.

Before borrowing from your future, consider whether your need is truly urgent, like a financial emergency or escaping high-interest debt. Explore all your options first - your retirement savings should be your last resort, not your first choice.

A 401(k) loan lets participants borrow from their vested account balance. The amount you can borrow depends on your plan's rules, but most plans offer loans up to $50,000 or 50% of the vested balance—whichever is less.

A 401(k) loan allows you to access funds without needing credit approval. You pay interest back into your own account instead of to a lender, and it may help in situations like purchasing a primary residence or covering emergencies.

Borrowing reduces your invested retirement savings, leading to foregone growth over time. If you don't repay on time—or leave your job with an outstanding balance—it could be considered a taxable distribution and subject to income taxes.

You make regular payments through payroll deductions using after-tax dollars as part of your repayment plan until the loan is paid off. Missing payments can result in penalties or tax consequences.

Hardship withdrawals are only allowed under strict conditions like medical expenses or preventing eviction. Unlike loans, they cannot be repaid—and they're counted as taxable income—so they're often seen as a last resort.

Yes! A financial planner or human resources representative can guide you through options based on available loan amounts, tax implications, and long-term effects on preparing for retirement goals.