Discover practical strategies for singles to plan a secure retirement. Take control of your future today—read the article for actionable tips!

Worried about funding retirement solo? It's a valid concern, but individual planning offers unique advantages without compromising a partner's priorities. With single households steadily increasing according to Census data, tailored retirement strategies for individuals become increasingly relevant.

This guide provides effective approaches to build financial security on your own, covering essential savings techniques, investment strategies, and health protection measures to ensure both your wealth and well-being remain strong throughout your retirement years.

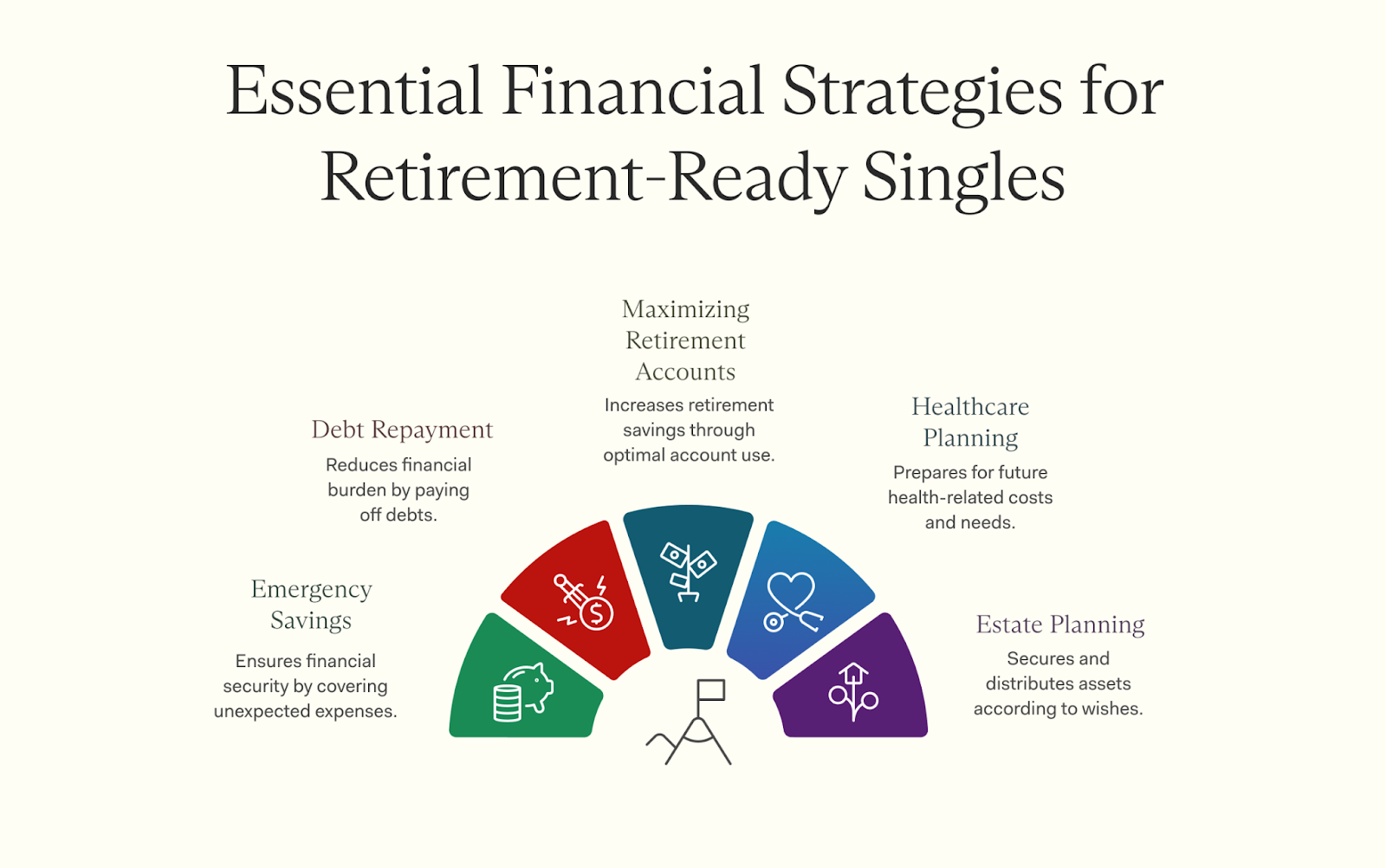

For singles getting ready for retirement, it's essential to save for emergencies and pay off high-interest debt.

The path to retirement security begins with establishing an emergency fund. This fund should hold enough to cover living expenses for three to six months. It acts as a financial safety net in case of job loss or unexpected health costs, keeping retirement savings on track.

Once the emergency fund is set, focus on paying off high-interest debt quickly. This step secures a stronger financial future for retirement.

Eliminating high-interest debt is key for single folks planning for retirement. This type of debt eats into your income and savings. Focus on credit cards or loans that charge high interest rates.

Set clear goals to pay these debts down quickly.

Use extra cash from your budget to knock out this debt first. It helps free up money for retirement accounts later on, like an IRA or employer-sponsored plan. Less debt means more financial power in your golden years—allowing you to enjoy life without stress about money.

Debt can feel heavy, especially when you're doing it alone.

Once your foundation is secure, turn your attention to building retirement accounts. Contribute to any employer-sponsored plans and consider IRAs, too.

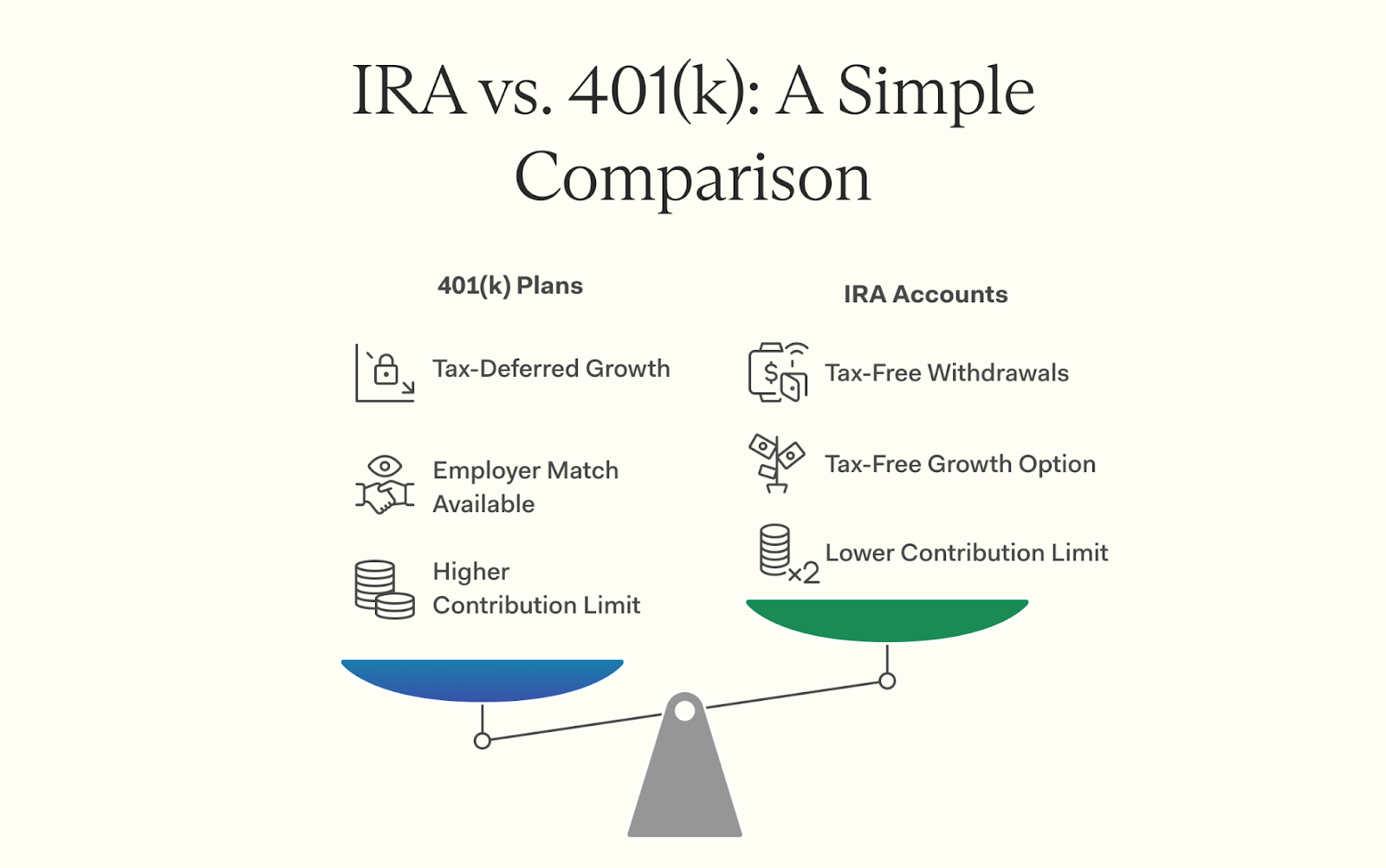

Employer-sponsored retirement plans can really boost your savings. If your job offers a plan, take advantage of it. Many companies match your contributions, which is free money for you.

Contributing enough to get that employer match can help build a strong financial foundation.

Plans like 401(k)s let you save and invest for retirement. The money reduces your taxable income each year too. Consider contributing as much as possible each paycheck, even if you're single.

This step will help create more retirement income down the line.

After contributing to employer-sponsored retirement plans, consider IRAs and other savings options. Individual Retirement Accounts (IRAs) offer tax benefits that can help you grow your savings.

There are two main types: Traditional IRAs and Roth IRAs.

A Traditional IRA lets you deduct contributions from your taxable income now, but you'll pay taxes later when you withdraw money. A Roth IRA works differently—you pay taxes on the money before putting it in, but withdrawals in retirement are tax-free.

Both options suit single people well. They provide a solid way to save for retirement while planning for financial goals.

Also, think about adding an investment account or a single life only annuity to your mix. These options can boost your cash flow during retirement too! Make informed choices with the right financial planner by your side.

Healthcare planning deserves special attention when you're single. It's smart to invest in health insurance. Long-term care insurance can save money later. Think about how you want to handle your health needs as you age.

Health insurance is key for singles. It helps cover medical costs and gives peace of mind. Look for a plan that fits your budget. Long-term care insurance is also important. This type of policy pays for help if you need it later in life, like home care or nursing homes.

Consider how much cash you'll need as you age. Having health coverage protects your savings and assets. It is notable that single women spend a higher percentage of their income on health insurance compared to single men. Planning now can save you money down the line and ensure you're ready for retirement age without stress.

Creating a thorough estate plan helps ensure your assets are distributed according to your wishes. Name your beneficiaries and set up a power of attorney. You want to make sure your wishes are clear. It's all about protecting what you've built.

Naming beneficiaries is crucial for estate planning, especially for singles. Your chosen family or close friends can receive your assets when you pass away. It's a simple step that ensures your wishes are clear.

This way, the right people get support after you're gone.

Consider who matters most in your life—like adult children or good friends. Make sure to update these names as life changes occur. For instance, if you previously married and have new plans, adjust your designations accordingly.

Naming beneficiaries helps prevent confusion and keeps peace among loved ones during tough times.

As part of your estate planning, it's crucial to establish a power of attorney concurrently while you name beneficiaries. This document empowers a trusted individual to make decisions on your behalf should you become incapacitated, covering critical areas such as your finances and healthcare.

Choose a trusted friend or family member whom you can appoint under separate power of attorney documents. Ensure you have a designated financial power of attorney for managing your financial matters, and a healthcare power of attorney for making medical decisions. This setup helps maintain clarity and ensures all aspects of your welfare are covered, especially in emergencies.

Think ahead about who will help manage your financial situation if needed. Make sure they have clear guidance on what to do with investment accounts and insurance policies while you're not able to decide yourself.

Retirement planning as a single individual comes with unique challenges, but with the right strategy, you can secure a comfortable and independent future.

Start by assessing your savings, optimizing tax-advantaged accounts, and creating a solid investment plan. Need expert guidance? A Farther financial advisor can help tailor a retirement plan just for you. Take the first step today!

Retirement planning as a single person puts you in complete control of your financial future. Starting with a solid foundation—building an emergency fund, eliminating debt, and maximizing retirement contributions—creates a strong base. Thinking ahead about healthcare needs and establishing a clear estate plan ensures your wishes are honored.

Planning strategically today builds confidence for tomorrow. Take charge, stay informed, and create a retirement that supports the independent life you value!

Retirement planning for singles involves special considerations, like setting up a support system and possibly joining a retirement community. Financial professionals can help with financial planning tailored to single person households.

The Social Security Administration suggests starting at full retirement age, but it depends on your personal situation. You may need more money earlier in retirement or prefer to wait and receive larger checks later.

An insurance policy is crucial, especially long-term care policies which cover costs like in-home care that married folks might have covered by their spouse. It's an essential backup plan when there's only one person in the household.

Yes, while married couples often have survivor benefits from Social Security, singles usually get more freedom in spending time and money throughout their entire life without considering another person's needs or wants.

Consider creating a solid financial plan with professionals, investing in an insurance policy for long-term care coverage and exploring options such as moving into a vibrant retirement community where you can enjoy golden years surrounded by other active older adults.