Learn how to effectively use the Roth IRA Conversion Ladder to enhance your retirement strategy. Discover practical tips and insights in our latest article.

Managing money can be challenging for military families, who often deal with frequent moves and fluctuations in pay. These unique circumstances make financial planning even more important. The good news? Military life offers special benefits that can help you navigate these challenges.

In this post, we'll share practical tips for managing money, maximizing military benefits, and planning for the future. We'll cover budgeting, saving, and preparing for retirement with programs like the Savings Deposit Program (SDP) and the Blended Retirement System (BRS).

Ready to take control of your finances? Let's dive in!

Military families encounter distinctive financial hurdles, such as frequent relocations and pay variations during deployment. These challenges make managing finances tough but not impossible.

Moving regularly is a significant aspect of life for many servicemembers and their families. These transitions involve dealing with selling or renting out homes, finding new schools for children, and adjusting to new communities.

This can be both challenging and costly. Each move typically brings unexpected expenses like deposits for housing or utilities.

Relocations extend beyond the physical move; they require financial adjustments too.

These moves also complicate maintaining a consistent financial plan. Families must be prepared to adapt their budgets quickly.

Income often fluctuates for military families during deployment periods. Service members may experience shifts in pay during active duty. While deployed, they often receive additional entitlements like Hostile Fire Pay, Imminent Danger Pay, and Family Separation Allowance, which can increase overall compensation. However, when not deployed, these additional pays are not provided, potentially leading to a decrease in income.

This variability makes financial planning a must.

Families need to plan for these ups and downs. A solid monthly budget helps manage expenses during tough months. Tracking spending keeps finances secure as circumstances change. Military pay often comes with unique benefits that can help maintain stability too.

Service members can utilize benefits provided by the Servicemembers Civil Relief Act to cap interest rates on pre-service debts at 6% during active duty. However, this benefit requires that service members submit a written request to their creditors, including a copy of their military orders, to invoke this right effectively.

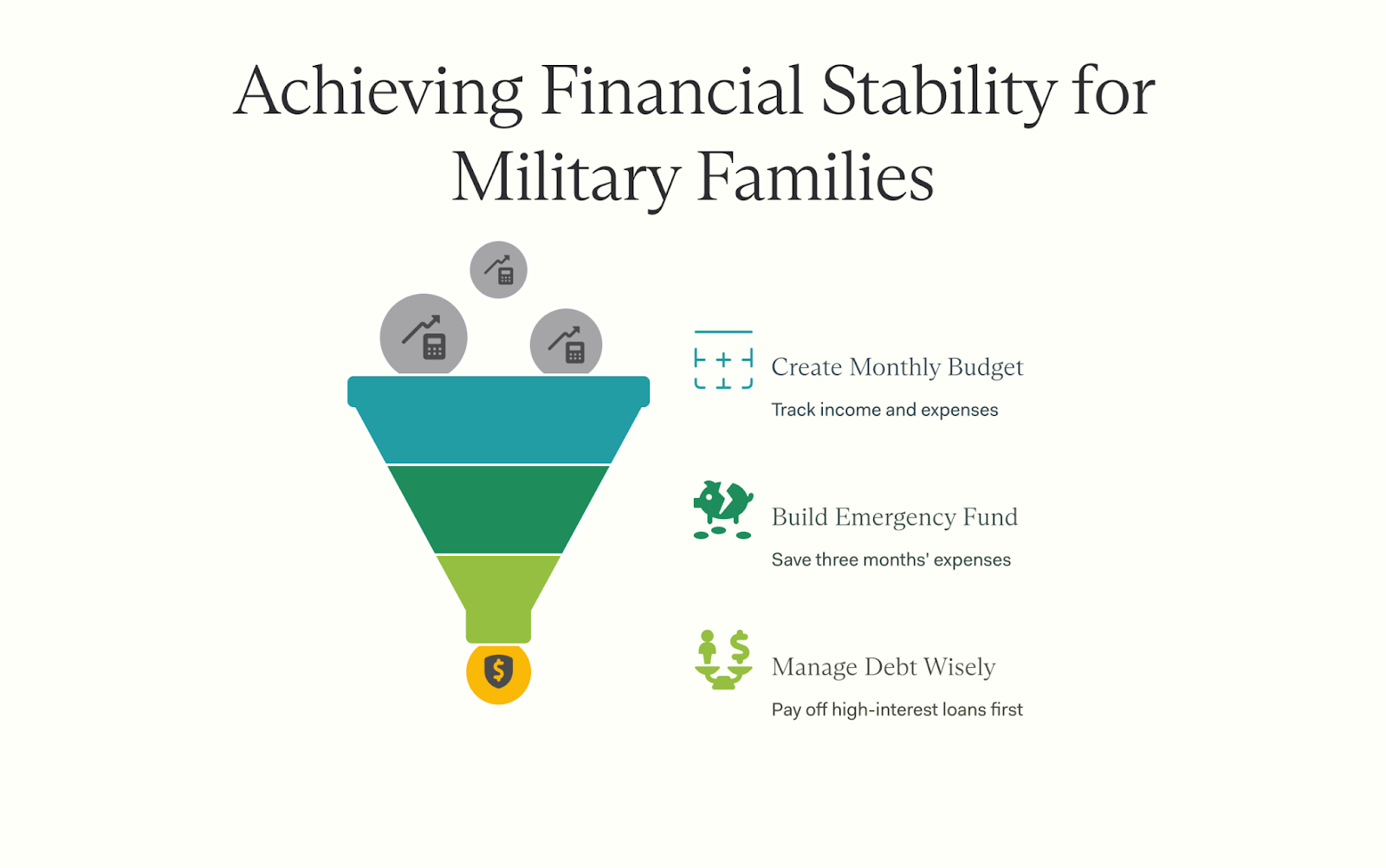

Establishing a detailed financial roadmap is crucial for military families. Tracking your income and expenses reveals spending patterns and helps allocate funds efficiently. Building an emergency fund provides a safety net for unexpected costs, with experts recommending at least three months' worth of living expenses.

Debt management requires strategic attention—prioritize high-interest loans and maintain timely payments. These fundamental practices lay the groundwork for long-term financial security.

Creating a financial roadmap helps military families monitor their spending patterns. This practice simplifies financial planning and supports achieving long-term goals.

A solid budget provides clarity in financial circumstances. It empowers military servicemembers to navigate unique financial challenges easily.

Financial security begins with establishing a safety net for unexpected events. Military families should aim to save three to six months' worth of expenses. This fund provides support during unforeseen situations, like sudden relocations or income fluctuations due to deployment when additional entitlements such as Hostile Fire Pay, Imminent Danger Pay, and Family Separation Allowance increase overall compensation. However, when not deployed, these allowances disappear, potentially leading to a decrease in income.

It offers peace of mind and financial stability.

Set aside a small amount each month. Use direct deposit if possible, so the money goes straight into your savings. Look for accounts with good interest rates that can help your funds grow.

Many financial planners recommend these steps for a secure future, especially when adjusting from military life to civilian life.

Debt can feel heavy, especially for military families. Managing it well is key to a strong financial situation.

Managing and reducing debt lays the groundwork for a solid financial footing for military families.

The unique perks that come with military service can significantly bolster your family's financial position. Programs like the Savings Deposit Program and VA home loans provide exceptional opportunities for saving money and managing housing costs effectively.

The Savings Deposit Program (SDP) helps military personnel save money during deployment. Service members can earn interest on their savings at a rate of 10% annually. This program is available for active-duty troops stationed in designated areas, where they cannot easily access their funds.

To participate, service members must deposit a minimum of $5 and can save up to $10,000. The SDP is an excellent option for military families wanting to build an emergency fund or save for future goals.

It's easy to enroll through the Defense Finance and Accounting Service. Take advantage of this great benefit!

The Blended Retirement System (BRS) combines a traditional pension with a savings plan. Active-duty members who joined on or after January 1, 2018, fall under this system. They get a monthly pension based on years of service and an automatic contribution to the Thrift Savings Plan (TSP).

This TSP helps military families grow their savings.

Members can also add personal contributions to the TSP for more growth potential. The BRS provides various benefits for military retirees, making it important for financial planning in military families.

Understanding how BRS works can help you make better decisions about your future finances.

Effective financial planning is essential for military families navigating unique challenges. Begin with fundamental strategies like creating a budget and establishing an emergency fund. Managing debt efficiently maintains financial health, while military-specific benefits like the Savings Deposit Program provide valuable support.

Consider how these strategies might fit into your own financial situation. Could creating a budget this month be your first step toward financial stability? The right planning today can transform your financial future.

Financial planning for military families is a comprehensive approach to managing finances, including income taxes, state taxes, and other financial obligations. Seeking help from an expert financial advisor can be an important part of building your plan.

Financial protections assist military members by reducing their tax obligations and offering credit monitoring services. They also provide complex benefits such as reduced interest rates on loans and additional legal residence rights that are unique to federal employees.

Absolutely! Disabled veterans have access to all the same resources - including small business support and education opportunities - plus additional cost assistance available specifically for them.

Your legal residence can impact your state tax obligations significantly. It's not just about your physical address but also where you're legally considered resident for taxation purposes.

Yes indeed! Comprehensive financial plans often include investment strategies which coupled with the complex benefits offered to federal employees, provide lucrative avenues for wealth creation.