Discover practical tips to save money for your future home. Learn budgeting strategies and smart saving methods. Start your journey to homeownership today!

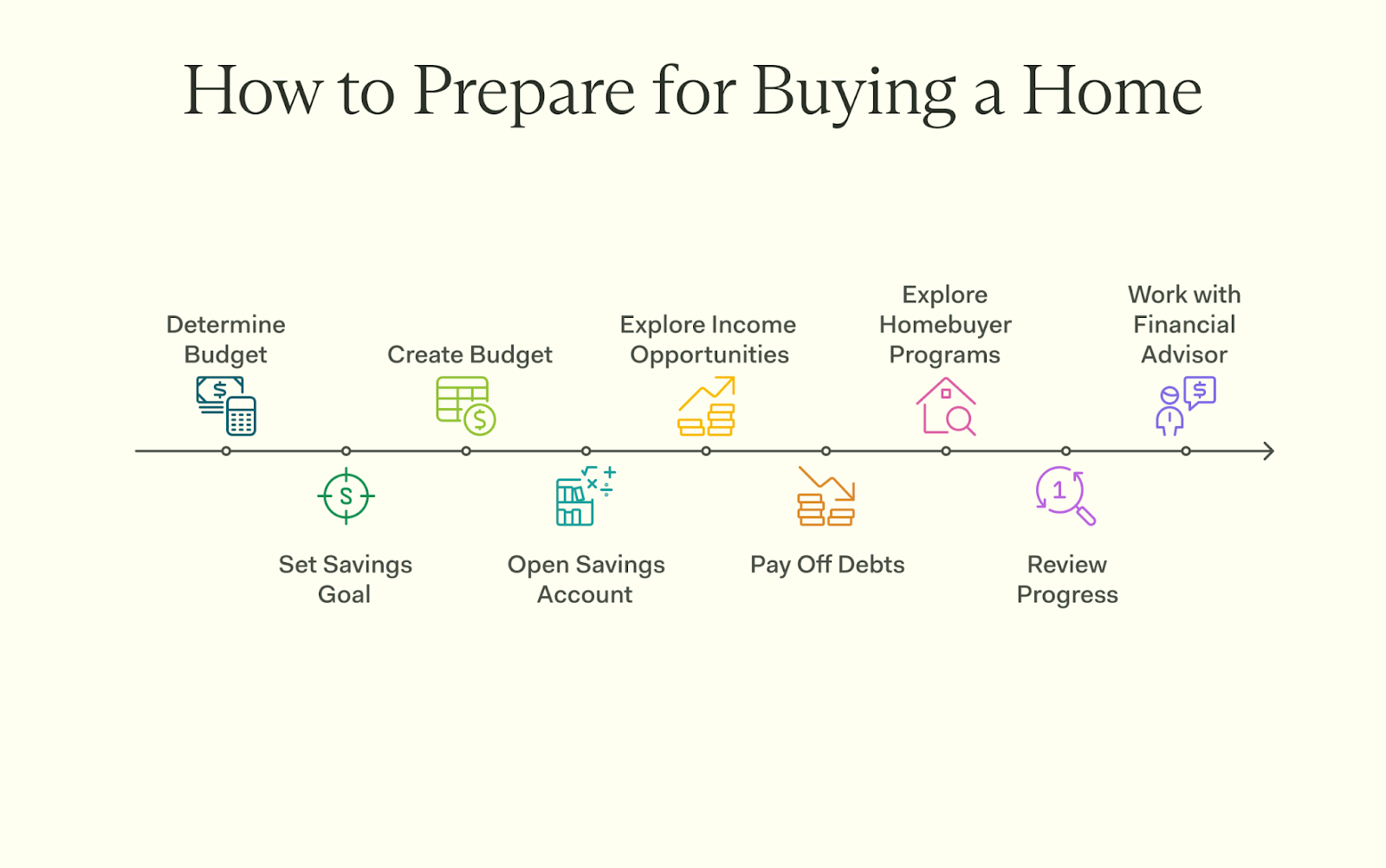

Saving for a home is an exciting goal, but it requires careful planning. The first major step is building a down payment, which brings you closer to homeownership.

Our guide will walk you through the process, from setting up a savings plan to managing debt, helping you prepare financially for your first home.

Understanding your affordability for a house begins with your income and expenses. Don't forget to factor in property taxes and insurance into your estimations.

Begin by reviewing your net income and expenses to determine how much you can afford for a home. Look at your after-tax monthly earnings, then list all your expenses, including food, bills, and car payments.

Don't forget to factor in smaller costs like entertainment and dining out, as they add up over time.

A budget is about telling your funds where to go instead of wondering where they got spent.

After listing your expenses, calculate what remains. This leftover amount can go toward saving for a down payment. If that number is lower than you'd like, look for ways to cut costs or increase your income.

For many loans, like FHA loans, you can pay as little as 3.5% if your credit score is 580 or above. For those with credit scores between 500 and 579, the minimum down payment is 10%.

Your housing budget needs to include more than just the mortgage payment. Property taxes are a big part of homeownership costs. They vary by location but can add hundreds or even thousands each year. Homeowners insurance is also essential. It protects your home and belongings from damage or loss.

These costs can change over time, too. Always check for current tax rates in your area. For insurance, shop around for quotes to find the best deal. Adding these expenses into your savings plan will help you avoid surprises later on.

Closing costs can add up quickly. They usually range from 2% to 6% of the home's sale price, and can vary depending on factors like location and the type of loan.

After all, being prepared means feeling confident about buying a house!

Determine how much money you need for a down payment and other costs before you begin saving.

A down payment is a key step in buying a house. It's usually a percentage of the home price. For FHA loans, the minimum down payment is 3.5% if your credit score is 580 or higher, but it goes up to 10% if your score is between 500 and 579. Higher down payments lower your monthly payment and avoid private mortgage insurance (PMI).

Think about how much money you want to save for the down payment fund. Include closing costs and other expenses in this plan too. A good rule of thumb is to aim for at least 20% of the purchase price if possible.

This helps with better loan terms and reduces long-term costs.

Next, consider closing costs and other expenses. Closing costs can add up quickly. They typically range from 2% to 6% of the home's sale price, depending on various factors like location and loan type. This can include fees for the mortgage lender, title insurance, and inspections.

Other important expenses come with buying a house too. These may include moving costs, repairs, or new furniture. You must also plan for property taxes and homeowners insurance in your budget.

All these factors make it clear that saving money isn't just about the down payment; you need enough savings to cover these extra costs as well.

Track your monthly spending. Find areas where you can cut back and save that extra cash for your future home.

Begin by documenting all your purchases. Write down everything you buy. This helps you see where your money goes. You might be surprised by unnecessary costs. It's a good idea to check how much you spend on eating out or shopping.

Cutting back can free up cash for saving. For example, making meals at home is cheaper than dining out. Finding areas to reduce costs helps meet your goal to save for a down payment on a house faster.

Keep an eye on those expenses each month, and adjust as needed!

Now that you have tracked your spending, look for areas to cut back. Start with small things like dining out or subscriptions you don't use often.

Even little changes can add up fast.

Review your spending habits regularly. Identify discretionary spending that isn't necessary for daily life. Can you stop buying coffee every day? That extra cash can go toward your savings goal for a house.

Focus on cutting costs so you save enough money to buy a home sooner than later!

Consider opening a dedicated savings account. Use a high-yield option to earn more interest and set up automatic transfers.

High-yield savings accounts are a smart way to save for a house. They usually offer better interest rates than standard savings accounts. This means your money can grow faster, helping you reach your goal sooner.

Look for accounts with no fees and easy access to funds.

Automating your savings in these accounts is also key. Set up direct deposits from your paycheck or other income sources. Every month, a set amount goes straight into savings without thinking about it.

This makes saving easier and helps keep you on track for that down payment!

Use a linked savings account to make saving easy. Set up automatic transfers from your checking account to your high-yield savings account. This way, you save every month without thinking about it.

Choose an amount that fits your budget but feels like a stretch.

Automating your savings helps you build funds for a down payment and closing costs faster. You won't even notice the money leaving your checking account each month. Saving becomes effortless this way.

Use any extra money, like tax refunds or bonuses, to boost those savings too!

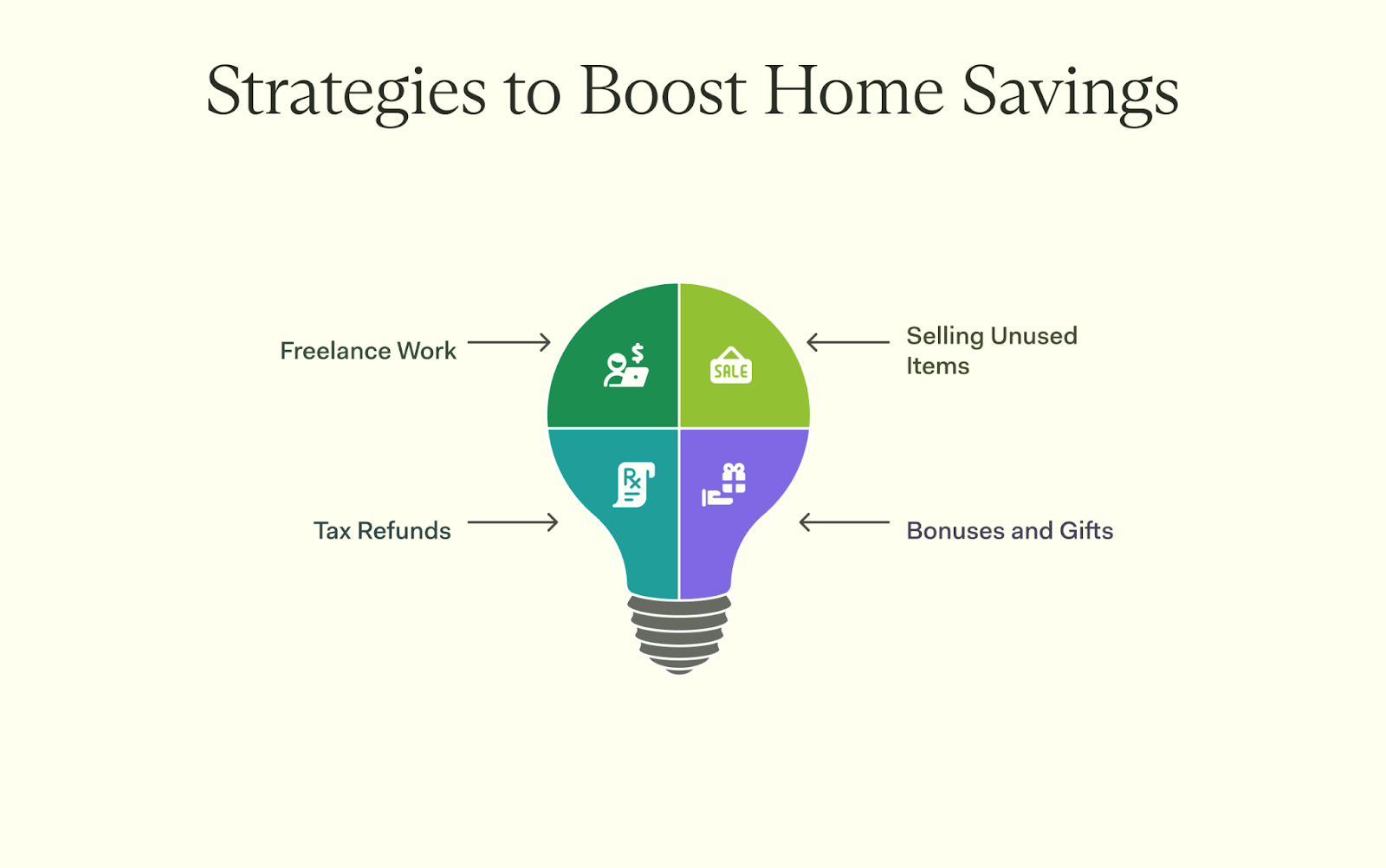

To save for a house, you might want to find ways to earn more money. Think about taking on side jobs or selling items you no longer need.

Freelance or part-time work can boost your savings for a house. You can earn extra money by using your skills online or locally. Look for jobs that fit your schedule, like graphic design, writing, or tutoring.

Selling unused items also helps you gather cash quickly while decluttering your space, but keep in mind the tax implications. If you sell items for more than what you paid, it's important to report any profit as taxable income. Conversely, losses from such sales cannot be deducted. Use platforms like eBay or Facebook Marketplace to make some easy money. Make sure to maintain accurate records of your transactions for tax purposes. This extra income can go right into your high-yield savings account.

Selling unused items is another way to earn extra cash. Look around your home. You may find clothes, electronics, or furniture you no longer use.

Online platforms make selling easy. Websites and apps like eBay or Facebook Marketplace help you reach buyers fast. Even a garage sale can draw in neighbors looking for deals. Use that money to save toward a down payment for a house.

It all adds up—every dollar helps!

Tax refunds and bonuses can give your savings a boost. Use that extra cash wisely—put it toward your future home!

When you receive your tax refund, put it toward building your house savings. This money can help you reach your down payment goal faster. If you get a big refund, consider putting the whole amount into a high-yield savings account.

This way, your cash will grow as you save.

You might also want to use part of it for closing costs or emergencies related to homebuying costs. Every little bit helps when saving for a house. Even small amounts add up over time! Make sure this windfall goes straight into your fund for buying that first-time home.

Bonuses and gifts can boost your savings fast. However, it's important to note that while bonuses from employers are considered taxable income, gifts received from family or friends are generally not taxable to the recipient. Nonetheless, large gifts may have tax implications for the giver. Instead of spending that extra cash, put it in a dedicated savings account. This helps you get closer to your down payment faster. You might receive gift money from family or friends.

Use this wisely.

All these funds add up quickly. Keep in mind, every little bit counts toward your home purchase goals. Next, let's explore how to pay off existing debts effectively.

Paying off debts can boost your credit score. A better score means you may qualify for lower loan rates when buying a house.

High-interest debt can hold you back from saving for a house. Focus on paying off credit cards and loans with high rates first. This will lower your monthly bills. Improving your credit score helps too.

Less debt means more money to save.

You can start by making extra payments on these debts. Cutting spending in other areas lets you allocate more funds toward repayments. The quicker you pay off this debt, the sooner you'll reach your home-buying goals.

A good debt-to-income ratio helps you get approved for a home loan. This ratio shows how much money goes to paying your debts each month compared to what you earn. Lenders often look for a ratio below 36%.

To improve it, pay off high-interest debt first. Focus on credit cards and loans that drain your income.

You can also increase your income to boost this ratio. Get a higher-paying job or take on freelance work. As rent payments eat into your budget, these steps will help free up cash for savings.

Getting the right financial plan is key. Next, let's explore first-time homebuyer programs.

You might want to check out first-time homebuyer programs. They can offer help with down payments and other costs, making it easier for you to buy a home.

Down payment assistance can help first-time homebuyers. Many programs exist to support people in buying a house. Check if you qualify for these options. They may require certain income levels or credit scores.

Some programs offer funds that cover part of your down payment or closing costs.

Look into local, state, and federal options. Federal options include FHA loans, available to all qualified borrowers, and VA loans, which are for eligible veterans, active-duty service members, and certain military spouses. These programs can help reduce the burden of upfront costs, making home buying more accessible and helping you reach financial goals easier.

Start by contacting a loan officer in your area for more information on eligibility and available resources.

FHA and VA loans can help first-time buyers save money. FHA loans generally require a down payment of 3.5% if your credit score is 580 or above; however, if your credit score falls between 500 and 579, you will need to make a minimum down payment of 10%. They are backed by the Federal Housing Administration, making them easier to qualify for.

VA loans, which are available for veterans, active-duty service members, and certain military spouses, typically do not require a down payment. It's important to note that a down payment might be necessary in specific scenarios, such as loans exceeding VA loan limits or if the borrower has partial entitlement. Both options offer lower interest rates compared to conventional mortgages.

Look into these programs if you want to buy a house without a huge upfront cost. Check your eligibility for down payment assistance through these loans. This could make homeownership more affordable for you.

Keep an eye on your savings. Check how much you've saved each month and see if you're on track for your goals.

Evaluate your savings plan often. Things change. Maybe you get a raise or have unexpected costs. Check your monthly income and expenses to see if you can save more—or less.

If you're falling behind, cut back on some spending. Look for money-saving tips to help you save for a down payment faster. If things are going well, consider boosting your monthly savings amount.

Always aim for that big goal of enough cash in the bank for a house—adjust as life changes!

Every time you save money, take a moment to recognize your efforts. If you reach a savings goal, treat yourself. This could be as simple as enjoying a nice meal or buying a small gift.

Tracking your progress helps too. It keeps you motivated and shows how far you've come in saving for that down payment on a home. Use any extra cash—like tax refunds or bonuses—to boost your savings even more...every little bit counts!

Keep aiming toward that goal of homeownership while feeling good about what you've achieved along the way.

Saving for a home involves more than just setting aside money for a down payment. You need a strategy that balances your short-term savings with long- term financial security, while also considering taxes, mortgage options, and investment opportunities.

A Farther financial advisor can help you create a personalized savings plan, optimize your investments, and ensure you're financially prepared for homeownership.

Make your dream home a reality. Talk to an advisor today to start planning.

Saving for a home requires planning, discipline, and smart financial choices. Start by setting clear goals, tracking expenses, and finding ways to save more effectively.

A high-yield savings account can help grow your funds, while additional income sources like side work or selling unused items can accelerate your progress.

By taking these steps, you'll build confidence in your financial future and get closer to homeownership. Even small changes add up. For more guidance, consult local homebuying experts or a financial advisor to customize your plan.

Start by estimating the loan amount and down payment requirements based on the type of loan you're interested in. Then, figure out how much you need to save per month over a specified period to reach your goal.

Consider opening a high yield savings account which offers an APY that can help your money grow faster. Also, consider cutting back on unnecessary spending and putting aside bonuses or raises directly into your payment savings.

Absolutely! Many national associations offer down payment assistance programs specifically designed for first time buyers, including veterans affairs organizations.

Yes, having an emergency fund is key in financial planning when looking to buy a home – it provides wiggle room should unexpected costs arise during the homebuying process.

It's always good idea to save enough funds not just for down payments but also closing costs and emergencies - these could be roughly estimated at 2-5% of the loan amount.

Indeed! Mortgage lenders often allow borrowers to use gift money towards their down payment while renting or even as part of their total annual income calculation.