Discover how the Mega Backdoor Roth IRA can help you boost your retirement savings. Learn the strategies to make the most of this powerful tool.

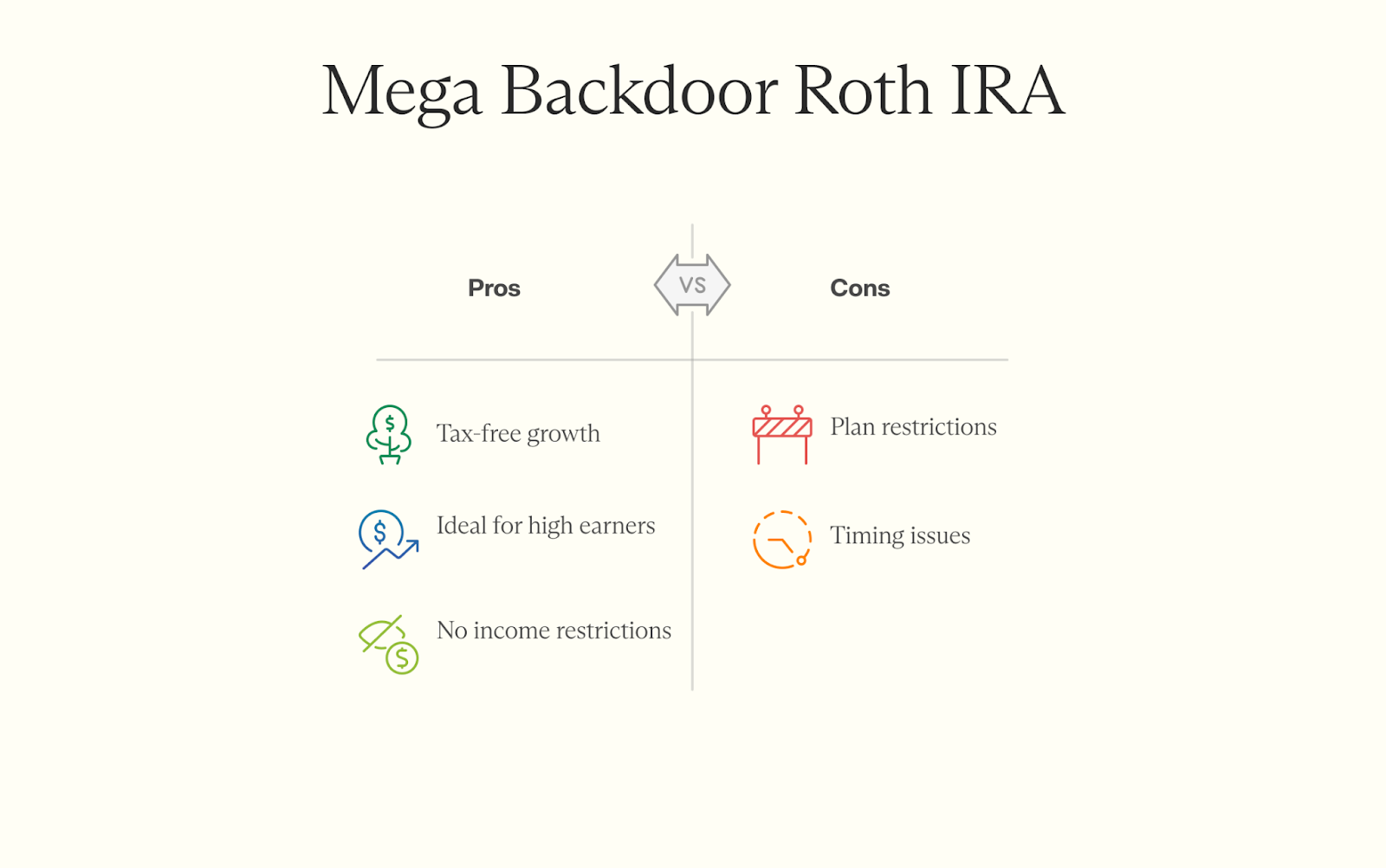

How can you maximize tax-advantaged retirement savings beyond traditional limits? The Mega Backdoor Roth IRA offers a powerful solution. This strategy enables individuals to make substantial after-tax contributions to 401(k) plans, then convert these funds to Roth accounts for completely tax- free growth. With potential contribution amounts far exceeding standard retirement account limits, this approach can dramatically accelerate your tax- advantaged savings.

This guide explores the Mega Backdoor Roth's mechanics, eligibility requirements, and significant advantages for your long-term retirement planning.

A Mega Backdoor Roth IRA is a strategy, not a specific type of account, which enables high earners to use after-tax contributions within their 401(k) plans to contribute beyond the standard limits by converting them into a Roth IRA or Roth 401(k). This strategy allows the funds to grow tax-free.

The IRS sets caps on yearly retirement contributions, but after-tax contributions to a 401(k) count towards the overall annual limit, which includes employee deferrals, employer contributions, and these after-tax contributions. For 2025, this total limit is $70,000, or $77,500 for those aged 50 and over. Once in the Roth, money can be taken out tax-free during retirement.

This is beneficial for people with incomes too high for regular Roth IRA contributions. It offers an opportunity to increase savings and enjoy the advantages of tax-free growth and withdrawals.

This retirement strategy involves making after-tax contributions to your 401(k) and then converting these funds to a Roth IRA or Roth 401(k) for tax-free growth. It's important to note that this doesn't create a new type of IRA but utilizes existing accounts to maximize your retirement savings.

The Mega Backdoor Roth IRA strategy begins with making after-tax contributions to your 401(k). After ensuring that your plan allows for this, you can then move that money to a Roth IRA or Roth 401(k) for tax-free growth, although not all 401(k) plans support after-tax contributions or in-service distributions necessary for this plan.

Employer matching contributions generally do not apply to after-tax contributions. Verification with your employer about whether they match these contributions is essential, as it is not commonly practiced.

You can convert after-tax contributions from your 401(k) directly to a Roth IRA, commonly known as a rollover, or to a Roth 401(k), referred to as an in-plan Roth conversion. Understanding these conversions' specific regulations and tax implications is crucial.

It is critical to review your employer's plan specifics, as not all plans permit in-service distributions of after-tax contributions necessary for executing a Mega Backdoor Roth strategy. If your plan allows these distributions and you're considering conversion, consulting a tax professional is advisable to navigate the potential taxes on earnings and the overall impact on your tax situation effectively. They can provide valuable guidance throughout the conversion process.

To use a Mega Backdoor Roth IRA, you need to be part of an employer plan that allows after-tax contributions. There are no IRS income limits that restrict eligibility for this strategy, allowing it to be accessible for high-income earners who want to contribute beyond the limits of direct Roth IRA contributions.

To set up a Mega Backdoor Roth IRA, your employer's 401(k) plan must allow after-tax contributions. Not all plans do this. Check with your plan administrator to see if they support this feature.

Your employer should also facilitate some form of transfer from your 401(k) into a Roth account, either through in-service distributions that allow transfers into a Roth IRA or through in-plan conversions to a Roth 401(k) if in-service distributions are not available. If these requirements are not met, the Mega Backdoor Roth strategy won't work for you.

Income plays a big role in the utilization of a Mega Backdoor Roth IRA, benefiting high-income earners the most. If your modified adjusted gross income exceeds certain limits, you might miss out on direct Roth IRA contributions, but with after-tax contributions to a 401(k), you can still get tax advantages.

Your employer's plan must allow these after-tax contributions for you to utilize the Mega Backdoor option. Check if they also permit easier conversion options like in-service distributions or in-plan rollovers.

These factors help determine if this retirement strategy makes sense for you and your financial goals.

For the Mega Backdoor Roth IRA, contribution limits can be substantial. You can contribute after-tax dollars up to the overall limit of your 401(k) plan. In 2025, the total contribution limit for defined contribution plans, including 401(k)s, is $70,000 for individuals under 50 years old. Individuals aged 50 and over can make an additional catch-up contribution of $7,500, bringing their total limit to $77,500.

This limit encompasses elective deferrals (pre-tax and Roth contributions), employer matching and profit-sharing contributions, and after-tax contributions. It's essential to ensure that the sum of all these contributions does not exceed the annual limit.

You need to check if your plan allows after-tax contributions and understand the specific features of your employer's plan, such as whether it permits in-plan conversions to a Roth 401(k) or requires in-service distributions to transfer values to a Roth IRA. Not all plans offer these features. The amount available for after-tax contributions depends on the total contributions already made to the 401(k) plan, including elective deferrals and employer contributions. After-tax contributions can fill up the remaining portion of the annual contribution limit.

If you're a high-income earner looking to save more for retirement, this strategy may assist in boosting your savings while enjoying tax-free growth potential later on.

You can grow your money tax-free with a Mega Backdoor Roth IRA. This means you won't pay taxes on earnings when you take them out later. It's a great way to save more for retirement, especially for high-income earners.

A Mega Backdoor Roth IRA allows after-tax money to grow tax-free. This means no income taxes on earnings as long as you follow the rules. You contribute after-tax dollars to your 401(k).

Later, you can convert that money into a Roth IRA or a Roth 401(k).

The potential for tax-free growth is huge. Your savings can grow without worrying about future taxes. When it's time to withdraw, those earnings come out tax-free too. This makes it an attractive option for high-income earners and small business owners looking to boost retirement savings while enjoying tax benefits.

Tax-free growth potential boosts your savings. With a Mega Backdoor Roth IRA, you can save more for retirement. It allows high-income earners to contribute after-tax dollars to their 401(k) without being constrained by the income limits that affect direct Roth IRA contributions.

This is money that grows tax free.

You can then convert these contributions to a Roth IRA or Roth 401(k). This step lets you enjoy even greater tax benefits in the long run. More contributions mean bigger savings at retirement.

Making use of this strategy helps ensure you have enough money when it's time to retire, but it's important to remember that while qualified withdrawals from a Roth IRA are tax-free, non-qualified withdrawals may be subject to taxes and penalties. Proper planning is essential to avoid unintended tax consequences.

A Mega Backdoor Roth IRA can have some drawbacks. First, not everyone can use this strategy. You need a 401(k) plan that allows for after-tax contributions and in-service distributions. Some employers do not offer these options.

Second, while direct Roth IRA contributions have income limits, the Mega Backdoor Roth allows high-income earners to bypass these limits, enabling them to contribute to a Roth account despite their high income levels.

Lastly, withdrawing money from your Roth account requires understanding the rules for Roth IRA distributions. Qualified withdrawals are tax-free, but non-qualified withdrawals may incur taxes and penalties. It's crucial to plan these withdrawals carefully to avoid unintended financial consequences.

Mistakes could result in taxes or penalties that take away some of the benefits you've gained from tax-free growth. Always seek advice from a financial advisor before moving forward with this strategy.

To set up a Mega Backdoor Roth IRA, start by checking if your 401(k) plan allows after-tax contributions. Then, talk to a financial advisor to guide you through the steps and help maximize your retirement savings.

Setting up a Mega Backdoor Roth IRA can help you grow tax-free. Follow these steps to start the process.

These steps will guide you through setting up a Mega Backdoor Roth IRA effectively.

A financial advisor can help you maximize a Mega Backdoor Roth IRA. They know the details of after-tax contributions and how to convert them into a Roth IRA or Roth 401(k). Their expertise is valuable, especially for high-income earners who face specific income limits.

Get expert guidance from a Farther financial advisor to ensure you're optimizing your retirement strategy while staying compliant with IRS rules!

A Mega Backdoor Roth IRA offers a powerful way to maximize your retirement savings beyond traditional limits. By making after-tax contributions to your 401(k) and converting those funds to a Roth account, you can enjoy tax-free growth on a much larger portion of your savings. This strategy particularly benefits high-income earners who might otherwise be limited in their tax-advantaged retirement options.

Before implementing this approach, verify that your employer's plan permits the necessary features. A financial advisor can help navigate the process and ensure it aligns with your overall financial goals. Taking action now could significantly enhance your retirement security—consider whether this strategy might strengthen your financial future.

A Mega Backdoor Roth IRA allows you to contribute after-tax dollars to a 401(k) plan, then convert the after-tax portion into a Roth IRA. This process works around the traditional income limits of a Roth IRA.

Yes, they can! High-income earners often use this strategy because there are no income limits to make after-tax contributions or in-service distributions from your 401(k) plan.

Once your after-tax money is converted into a Roth IRA, it grows tax-free. When withdrawn during retirement, these funds are also tax-free.

backdoor roth method?

Nope—the employer match doesn't impact this process as it goes into the pre- tax section of your 401(k).

through this method?

The total amount that can be contributed (including both pre-tax and post-tax contributions plus employer matching) to all your accounts in one tax year must not exceed $70,000 (or $77,500 if you're over age 50) in 2025.