Explore the differences between Special Needs Trusts and ABLE Accounts to make an informed choice for financial security. Read the article for guidance.

Choosing the right plan to support someone with disabilities can be challenging. You want to provide assistance without jeopardizing their eligibility for public benefits like Supplemental Security Income (SSI).

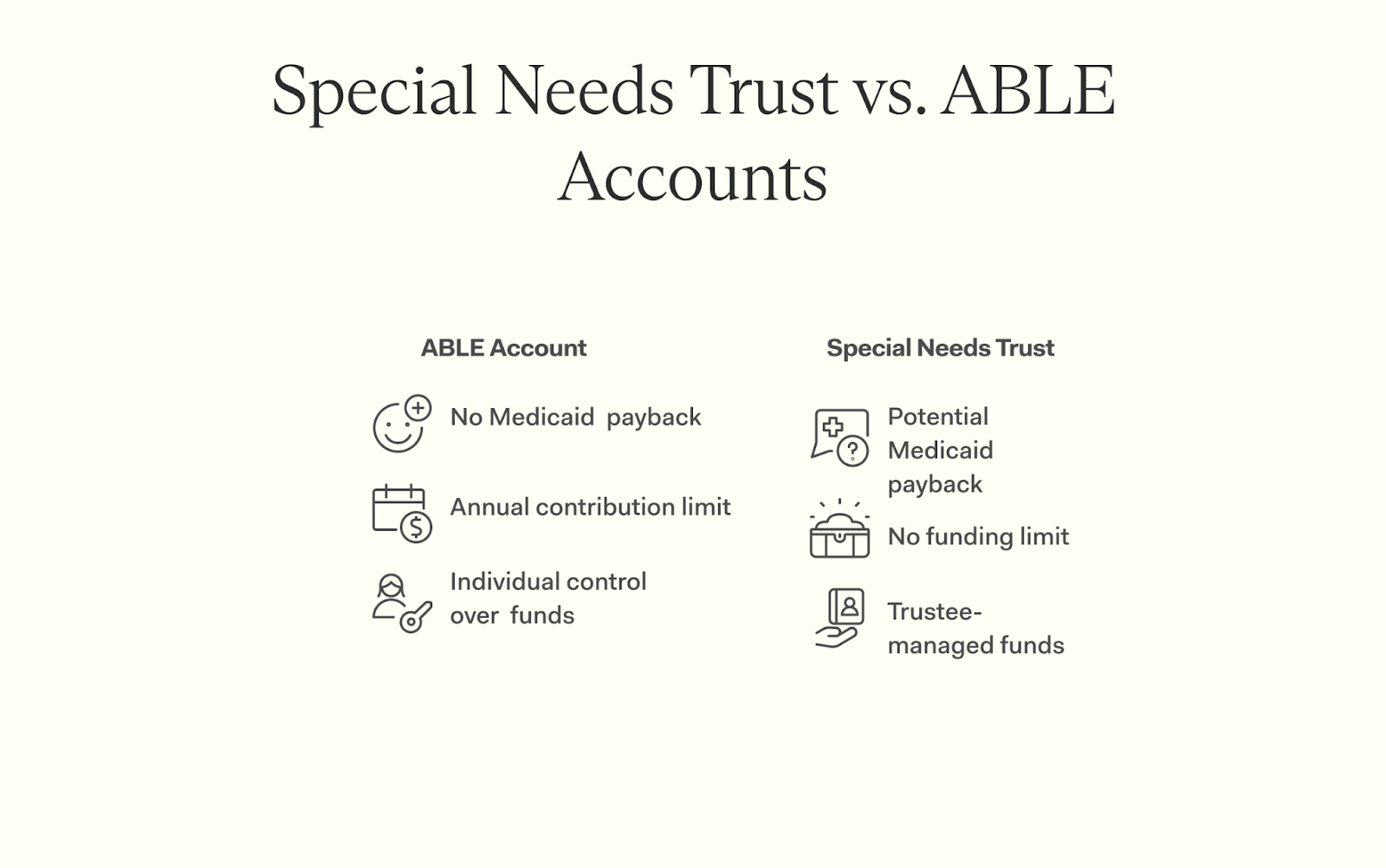

One significant decision is whether to use a Special Needs Trust (SNT) or an ABLE account. Each has distinctive rules, particularly regarding funding limitations and permissible uses.

We'll examine factors such as eligibility requirements, contribution caps, and authorized expenditures for both options.

A Special Needs Trust serves as a legal mechanism to help someone with disabilities maintain their government benefits. It holds assets for their benefit while ensuring continued eligibility for programs like Medicaid or SSI.

Special Needs Trusts are legal arrangements that help individuals with disabilities. These trusts manage and protect assets without risking eligibility for government benefits like Supplemental Security Income (SSI) and Medicaid.

They provide financial support for expenses not covered by these benefits, focusing on improving the beneficiary's life quality.

ABLE accounts are tax-advantaged savings accounts for people whose disability began before age 26, but this age limit is set to increase to 46 starting in 2026.

Both ABLE accounts and SNTs aim to ensure that individuals with disabilities can enjoy a higher quality of life without losing critical government assistance.

The management of a Special Needs Trust falls to a designated trustee. This individual oversees the funds and ensures proper utilization. The trustee must adhere to strict guidelines established in the trust document.

They handle all financial decisions, like paying bills or making investments.

An ABLE Account gives more control to the disabled individual or their authorized representative. They can manage their own money within limits. This account lets them pay for qualified disability expenses easily, without needing a middleman.

Each account has an annual contribution limit set by IRS regulations, which helps in planning carefully for future needs while still keeping benefits intact.

Special Needs Trusts funds can vary significantly based on state laws and the type of trust involved. Contributions may come from a beneficiary's assets or from family members or others when it's a third-party SNT.

ABLE Accounts have strict contribution limits as well. For 2025, you can contribute up to $19,000 per year. If you are employed and do not have an employer-sponsored retirement plan, you can contribute even more—your entire gross income for the year, up to $15,060 for residents of the continental U.S., $18,810 for Alaska, and $17,310 for Hawaii.

The range of permissible expenses differs between Special Needs Trusts and ABLE accounts. Both funding vehicles help cover disability-related costs. SNTs can finance various essential items, including personal support services, medical care, and legal fees.

They must enhance the beneficiary's quality of life without interfering with means-tested government benefits, such as Supplemental Security Income (SSI).

ABLE accounts focus on qualified disability expenses too. These may include education costs, employment training, or basic living expenses. Money in an ABLE account grows tax-free and can be used without risking Social Security benefits or Medicaid eligibility.

Medicaid payback requirements specifically apply to first-party Special Needs Trusts (SNTs), which are funded by the beneficiary's own assets. However, third-party SNTs, funded by others, do not have such requirements. In most cases, if a person who has used a first-party SNT received Medicaid benefits, they need to pay back those costs after passing away. This requirement affects financial planning and may impact what remains for heirs.

Understanding these rules is crucial for effective special needs planning. Without careful consideration, it could jeopardize remaining funds.

ABLE accounts provide a mechanism for people with disabilities to save money without forfeiting certain benefits. They allow funds to be set aside for disability-related expenses such as education and housing, while offering tax advantages as well.

An ABLE Account (Achieving a Better Life Experience Account) helps people with disabilities save money while preserving their eligibility for government assistance. Its primary function is to support qualified disability expenses without jeopardizing Social Security Disability Insurance benefits.

Similar to SNTs, ABLE accounts serve as vital tools for special needs planning and financial management. The key distinction is that while an SNT provides financial support without affecting means-tested benefits like SSI, an ABLE account has more specific savings parameters.

Both options offer different approaches to the same goal: enhancing quality of life for people with disabilities while maintaining access to essential government programs.

The management approaches differ significantly between these two options. With an SNT, a trustee takes charge of all funds. This individual makes all spending decisions and must comply with state regulations, which can be quite restrictive.

In contrast, ABLE accounts offer individuals with disabilities greater autonomy. Account holders can manage their own funds and determine how to allocate money for qualified disability expenses, including medical care and support services.

This distinction in control represents an important consideration when developing financial strategies for special needs planning.

Special Needs Trusts do not have strict funding limits; the amount that can be placed in an SNT depends on state laws and the type of trust. First-party SNTs, funded with the beneficiary's own assets, may have Medicaid payback provisions, while third-party SNTs, funded by others, do not.

For 2025, individuals can contribute up to $19,000 annually to an ABLE account. If the account owner is employed and does not participate in an employer-sponsored retirement plan, they may contribute an additional amount equal to their annual gross income, up to $15,060 for residents of the continental U.S., $18,810 for Alaska, and $17,310 for Hawaii.

The balance in these accounts won't affect Supplemental Security Income (SSI) benefits as long as it stays under $100,000.

Understanding approved expenses is essential for both Special Needs Trusts and ABLE accounts. These expenditures support individuals with disabilities without endangering their government benefits, such as Supplemental Security Income.

SNTs can fund various necessities including housing, education, or employment support. The expenditures must directly benefit the individual.

Similarly, ABLE accounts cover specific expenses. Funds may be used for healthcare costs, transportation, and other disability-related needs. A key advantage is that withdrawals from an ABLE account are typically tax-free.

Having clarity about what constitutes qualified disability expenses helps families make informed financial decisions while preserving eligibility for means-tested government benefits.

Special Needs Trusts (SNTs) do not provide tax-free growth; the tax treatment of SNTs depends on the trust's structure and applicable tax laws. However, the money in an ABLE account grows tax-free, and you can withdraw these funds without paying federal income tax if used for qualified disability expenses.

These options help people manage disability-related costs while keeping their benefits intact. It's important to consider the differences when planning finances.

Several important distinctions exist between SNTs and ABLE accounts. Each option features unique regulations regarding contributions, expenses, and eligibility that can significantly impact financial planning strategies.

Special Needs Trusts (SNTs) and ABLE accounts serve similar goals—helping individuals with disabilities manage resources without jeopardizing benefits—but they have distinct eligibility criteria. Here's how they differ:

In summary, SNTs are more flexible, accommodating individuals of any age and allowing broader establishment options. They're ideal for those already receiving government assistance like SSI or SSDI. On the other hand, ABLE accounts are more streamlined, allowing eligible individuals to manage funds independently, provided the disability began before age 26 and they live in the U.S. Understanding these distinctions is critical for choosing the option that best fits your situation.

Special Needs Trusts (SNTs) and ABLE accounts differ significantly when it comes to how much money can be contributed and how those contributions impact public benefits. Here’s a breakdown of their key financial parameters:

Each tool offers strategic advantages for individuals with disabilities. SNTs are better suited for managing large sums and complex financial planning without public benefit disruption. ABLE accounts, while limited by annual and lifetime caps, offer simplicity, tax advantages, and easier access for those who meet the eligibility criteria. The right option depends on personal goals, the size of the assets involved, and the level of flexibility needed.

The tax rules vary between Special Needs Trusts and ABLE Accounts. An SNT may offer certain tax benefits, potentially being income tax-free. Trust funds typically aren't considered taxable income for the beneficiary, though investment gains might be subject to taxation.

ABLE Accounts also provide tax advantages. Contributions come from after-tax money but grow tax-free when used for qualified disability expenses. This means no taxation on earnings or withdrawals when properly allocated. Both account types help safeguard SSI benefits while managing disability-related expenses without compromising eligibility.

State repayment requirements create another distinction between these financial tools. For SNTs, states may require reimbursement after the beneficiary's death to recover Medicaid or other means-tested government benefit costs provided during their lifetime. The state can claim remaining trust assets.

ABLE accounts are also subject to payback provisions, as remaining funds can be reclaimed by the state to cover Medicaid expenses incurred by the beneficiary. Understanding this distinction is essential for financial planning and addressing disability-related costs effectively.

Selecting the appropriate option requires careful consideration. Evaluate your specific financial circumstances and long-term objectives to determine which approach best meets your needs.

Financial considerations play a crucial role for individuals with disabilities. A Special Needs Trust can safeguard assets while managing funds for disability-related expenses. These trusts enable families to accumulate savings without affecting Medicaid or Supplemental Security Income eligibility.

Alternatively, ABLE accounts offer tax-free savings opportunities that preserve government benefit eligibility.

Both options have specific contribution parameters that must be understood. Whether to establish an SNT or an ABLE account depends on individual requirements and objectives. If spending flexibility is important, an ABLE account might be more suitable.

For long-term security, an SNT could represent the better option. Understanding your financial situation helps maintain eligibility for means-tested government benefits as well.

Beyond immediate financial needs, long-term strategy deserves attention. A Special Needs Trust works effectively for those seeking to secure the future of loved ones with disabilities. It can hold assets without compromising eligibility for means-tested government benefits.

This provides ongoing support security.

Alternatively, an ABLE account offers greater flexibility and simplicity. Funds can be used tax-free for disability-related expenses. Each option serves an important purpose in special needs planning.

Make your selection based on individual circumstances and future intentions. Consulting with a financial advisor or special needs planning attorney is advisable to fully explore all available options.

The question of financial autonomy follows naturally from long-term planning. A Special Needs Trust provides more structured fund management. You appoint a trustee to administer the assets, ensuring they're utilized appropriately for disability-related expenses.

This arrangement offers security but may restrict immediate cash access.

Conversely, an ABLE account provides greater individual control. The person with disabilities manages this account and determines how to allocate funds for qualified expenses such as healthcare or education.

With an ABLE account, you maintain ready access to your money while still enjoying tax benefits—including preservation of certain means-tested government program benefits. Spending flexibility helps accommodate changing needs over time.

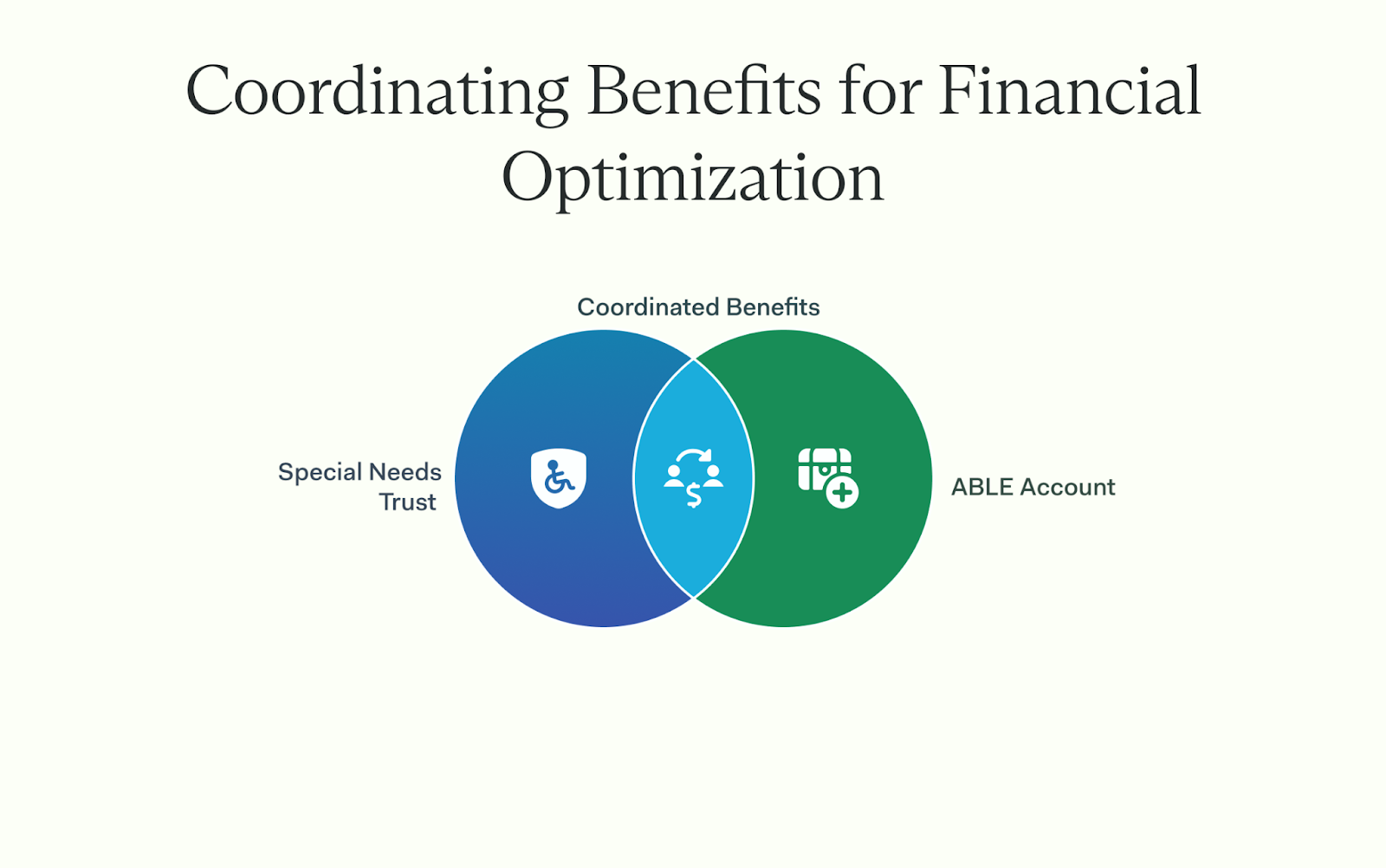

Utilizing both financial tools simultaneously can be advantageous. This approach allows you to coordinate benefits and maximize available resources effectively.

Proper benefit coordination optimizes support for those with special needs and improves resource management.

Employing both a Special Needs Trust and an ABLE account can enhance your financial strategy. These complementary tools address various disability-related expenses effectively.

Managing these resources wisely ensures better support for long-term goals related to disability needs.

Deciding between a Special Needs Trust and an ABLE Account represents a critical choice when planning for a loved one with disabilities.

Each option offers different benefits, tax implications, and eligibility rules that affect long-term financial security. A Farther financial advisor can help you navigate these choices, ensuring you create a plan that protects assets while preserving essential government benefits.

Make informed financial decisions with expert guidance. Talk to an advisor today to build a plan that best supports your loved one's future.

Special Needs Trusts and ABLE Accounts each offer distinct advantages for disability fund management. Their rules and benefits serve different purposes.

Match your selection to your specific goals and financial situation. Combining both tools often provides the most comprehensive support.

Your decision directly impacts your loved one's quality of life. Act now to establish the right financial protection for their future.

The main difference lies in how they affect eligibility for means-tested government benefits like Supplemental Security Income (SSI). Funds in a special needs trust don't count towards determining eligibility, while an ABLE account balance can impact it if it exceeds certain limits.

Yes! Both Special Needs Trusts and ABLE accounts are designed to cover disability-related costs without jeopardizing prior benefits. However, each has distinct advantages and specific rules on what qualifies as "disability-related". Special Needs Trusts can cover a wide range of expenses including personal care attendants, education, recreation, and other quality-of-life expenses, as long as they do not disqualify the beneficiary from receiving government benefits.

Absolutely! Contributions to third-party SNTs aren't tax deductible, but income generated within the trust is taxed. On the other hand, contributions to ABLE accounts are made with post-tax dollars but grow income tax-free.

Nope - you can only have one ABLE account per person according to Social Security Administration guidelines. However, a person can have multiple Special Needs Trusts.

ABLE accounts offer several investment options with varying risk levels, whereas first-party SNTs typically have less flexibility due to restrictions set by the National Resource Center on SSI program rules. Only first-party SNTs (funded with the beneficiary's own assets) are required to have Medicaid payback provisions. Third-party SNTs (funded by someone other than the beneficiary) are not subject to Medicaid payback requirements.