%20(1).avif)

High-touch, family office-level service with individualized attention to support you at every stage of life.

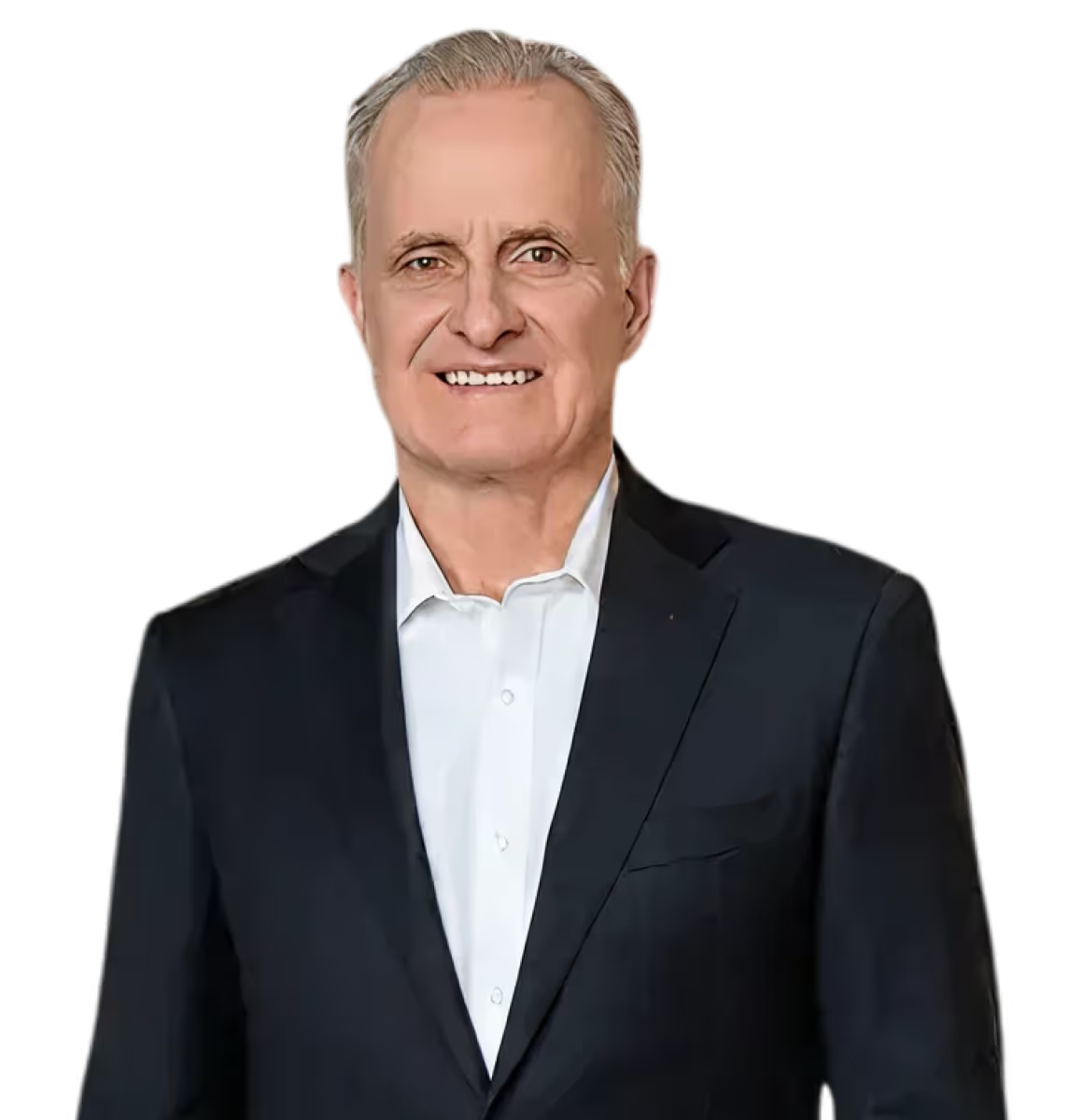

Marty brings nearly 30 years of experience serving high-net-worth families, business owners, and retirees. Before partnering with Farther in 2025, he spent 27 years with Commonwealth Financial Network, advising clients through every stage of wealth building and preservation. A CERTIFIED FINANCIAL PLANNER® professional, Marty specializes in complex financial life events such as business sales, retirement transitions, inheritances, and divorce & legal settlements. His team is particularly focused on strategic tax planning, helping clients enhance after-tax outcomes and protect wealth across generations.

Marty’s path into wealth management was anything but traditional. When he began advising clients three decades ago, he was simultaneously serving as a full-time firefighter for the city of Chicago. What started as a part-time endeavor grew into Gaughan Wealth Management, the independent firm he later founded. Though he has long since retired from firefighting, his admiration for those who serve – police, fire, and military – remains strong, and many of those individuals are clients today.

A Chicago native, Marty graduated from DePaul University with a Masters of Business Administration (MBA) degree. He enjoys spending time outdoors—whether skiing, hiking, or playing golf—and takes pride in helping clients build the financial freedom to enjoy the lives they envision. He also treasures time with his three adult children – Audrey, Megan and Danny, and his grandson James.

Fiduciary Standard

Your interest always comes first

Tax Alpha

Higher returns, not by taking more risk but from reducing the drag of taxes

Sophisticated Strategies

Exclusive access to Private Markets: Real Estate | Venture Capital | Private Equity

Elite Technology

Higher efficiencies, Lower costs, Increasing wealth

.webp)

.webp)

Your all-in-one financial ecosystem

Your full wealth picture,

in one place

Navigate with ease through a simplified dashboard that empowers you to take command of every financial decision.

Share specific financial data with your CPA, attorney, and family members — promoting transparent and collaborative wealth management.

Store every financial document in one organized, secure, and easily accessible location.

Our intelligent system continuously monitors your bank accounts — maintaining your liquidity, while ensuring excess cash is efficiently invested and working to increase your wealth.

Find answers and perform financial tasks swiftly with just a few clicks, from anywhere, at any time.

With modular investment options from Farther Asset Management and exclusive partners, you and your advisor can personalize your portfolio for your needs.

Our team, focused on your results

A higher standard of wealth advice

We understand that advisor relationships can sometimes fall short of expectations. Our approach transforms common pain points into proactive solutions, delivering a seamless, elevated client experience.

Clear, consistent communication

Tax-intelligent portfolio design

Disciplined, long-term investing

Proactive estate planning

Regular insights and clarity

Addressing the sophisticated needs of modern investors

We partner with clients who value thoughtful, strategic financial management and a high level of personal attention, including:

.avif)

.avif)

.avif)

.avif)

%20(1).avif)

.svg)