What began as a short note has gotten longer with the major news items that started the month.

This summary contains a few of the key highlights covered in this piece:

- First Republic’s bank failure is another major banking crisis event.

- Recent bank failures have been caused by the rapid increase in both short-term and long-term rates. The mismatch between lending long-term at lower rates and borrowing short-term at high rates is hurting the balance sheets and income statements of banks.

- Banks with high percentages of uninsured deposits have experienced failures.

- Regional banks are likely to remain most vulnerable.

- Commercial real estate loans are predicted to show more stress in the coming months.

- An FDIC guarantee of all deposits may be necessary to stop bank runs, but not sufficient to solve the stress on banks’ balance sheets and income statements — caused by higher interest rates.

- The Federal Reserve’s stated goal of keeping interest rates “higher for longer” to combat inflation is likely to exacerbate the banking crisis.

- Investors need to pay attention to keeping their cash balances safe. We recommend moving cash balances into U.S. Treasury Money Market Funds, U.S. Treasury Bills, or ETFs that own U.S. Treasury Bills. This move has the benefit of improving safety and yield on cash. Further details on this important topic are included below.

- Debt ceiling discussions and further bank failures have the potential for downside stock and bond market risk. We will look for opportunities in the markets if they arise.

- We encourage you to connect with your Farther advisor for any further questions.

May started with another major bank failure

The 8.0 financial market earthquake we saw in March with the collapse of Silicon Valley Bank had another aftershock during the last week of April and into the start of May. First Republic Bank (FRB) was seized by the FDIC and sold to JPMorgan in the second largest US bank failure (pushing Silicon Valley Bank’s failure to the third largest).

Depositors were made whole, but all bondholders, preferred, and common stock owners were wiped out. First Republic’s balance sheet was subject to many of the same issues that had affected Silicon Valley Bank (SVB): long-term, low-interest rate assets (in FRB’s case they owned a large amount of low-interest rate jumbo mortgages, whereas SVB owned low-rate interest securities), combined with a large portion of uninsured deposits.

First Republic’s collapse was slower, as the government had arranged a deposit infusion of $30 billion from other large banks and a credit facility from JPMorgan the week after SVB collapsed; however, in the following six weeks, FRB was unable to find a buyer for its business.

After its April 24 earnings release revealed that the bank had lost $100 billion of deposits in March and had to replace it with higher-cost, market rate funding, it became clear that FRB would, at best, survive as a “zombie bank” — and, at worst, need to be taken over by the FDIC and sold to another bank (which happened on May 1st).

What caused this banking crisis

Most banks made loans and purchased securities on their balance sheet in 2021 or earlier, when interest rates were much lower. Like bond investors in the public markets, banks’ assets suffered from the worst bond market in 40+ years – as long-term rates rose in 2022, pushing down the asset values of those loans and securities.

Banks are levered businesses, generally with a mismatch between the maturities of their assets and liabilities. They fund their long-term assets (loans and securities) with short-term client deposits and a relatively smaller amount of corporate borrowing and equity.

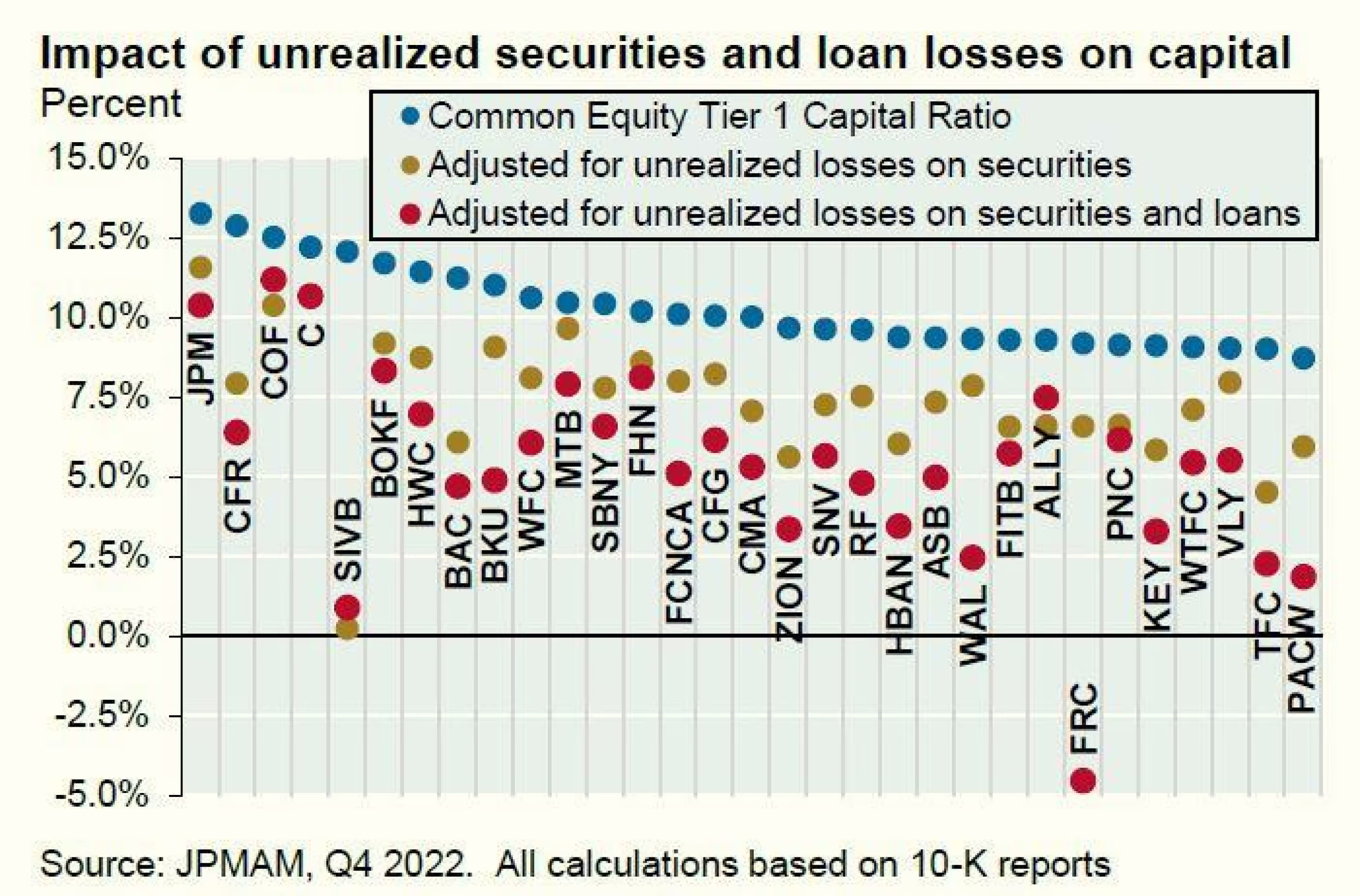

The below chart highlights the estimated impact of adjusting the capital ratios for major banks for unrealized losses in their securities and loan portfolios. Silicon Valley Bank (SIVB below) and First Republic (FRC below) are the two worst banks on this chart, but other banks have low adjusted capital ratios. Low adjusted capital ratios, combined with high uninsured deposits, have led to trouble for the banks that have been seized by the FDIC.

Why the banking crisis is very likely to continue

Both the asset and liability side of a bank’s balance sheet are critically important to its health. The above chart illustrates the effect of interest rate increases on banks’ balance sheets, but not the effect of any possible credit losses.

One likely source of credit problems in the banking sector is in commercial real estate loans (CRE), particularly in the office sector. A combination of lower occupancy rates caused by work-from-home trends following the Covid pandemic, lower rents, and higher cap rates have led to lower office building valuations.

The Wall Street Journal recently reported on an extreme case of a building at 350 California Street in San Francisco that was valued at $300 million in 2019 — now trying to be sold for $60 million. A lender who made a loan when interest rates were low, at a 70% Loan-to-Value ratio (LTV), would be underwater on their loan today if that building’s value had fallen more than 30%. If that loan needed to be refinanced, the lender may be forced to extend the loan or foreclose.

Already this year, owners such as Blackstone and Brookfield have defaulted on office building loans and returned specific properties to their lenders. Regional banks tend to have more CRE exposure than the largest banks in the country. Expect to hear more on this topic throughout the year.

On the liability side of a bank’s balance sheet: both the type of deposit (insured or uninsured) and the cost of those deposits to the bank are critically important to the bank’s health. As we’ve seen from the recent bank failures, the banks that have failed had high levels of uninsured deposits, whose rapid departure forced those banks to effectively recognize the losses on their assets.

A bank’s income statement is just as important as the quality of its balance sheet. Banks have been paying well below-market interest rates on their deposits to capture a positive net interest margin between what they receive on their loans and securities, and what they pay their depositors.

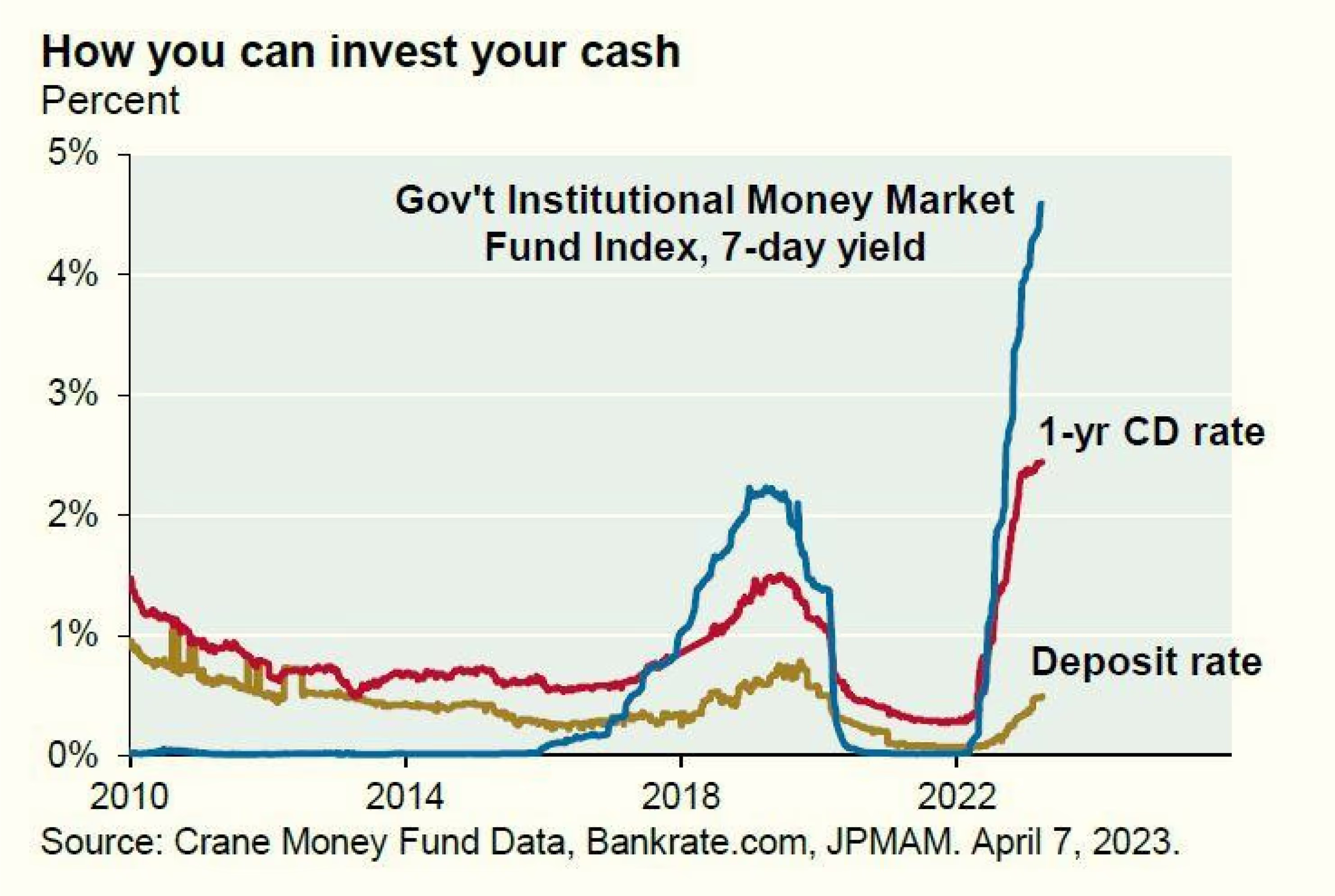

As can be seen in the below chart: average bank deposit rates are approximately 0.5%, while the average government money market fund is approximately 4.5%. When a deposit leaves the bank: that bank either has to sell an asset and reduce its balance sheet, or – as has been happening for the last 2 months – borrow from the Federal Reserve or Federal Home Loan at market-rates (i.e. 4.5-5%).

If a bank’s loans and securities yield 3%, and it pays 0.5% on their deposits, its net interest margin is a profitable 2.5%. If that bank’s deposits leave, or it’s forced to pay more to keep them at the bank, that net interest margin can flip from positive to negative quickly. Assets that 3% yield, with a 5% cost, lead to a -2% net interest margin loss.

This pressure on net interest margins is likely to continue – because whether a deposit is insured or uninsured at a bank, a bank client can almost certainly earn a higher, safe yield by investing in a U.S. Treasury or a U.S. Treasury MMF. Stated differently: how sound is the banking business model right now, if its continued profitability depends on dramatically underpaying clients on their deposits, relative to market interest rates?

What happens if Congress guarantees all bank deposits via the FDIC?

Normally, during bank failures: uninsured depositors take a haircut (i.e. loss) on their uninsured deposits. In March’s failures of Silicon Valley Bank and Signature Bank, the FDIC relied on a systemic risk exception to guarantee all deposits over $250,000 at the banks.

The President, the Treasury, FDIC, and Federal Reserve are all trying to preserve the safety and soundness of the banking system and declare that banking deposits are secure – implying safety, without explicitly guaranteeing deposits. Regulators are trying to instill confidence in the system, but Congressional legislation would be required to guarantee all bank deposits.

In 2008, Congress approved raising FDIC limits to $250,000 and created unlimited guarantees for a new type of TAGP account that paid zero interest (note that in September 2008, Treasury Bills also had zero yield, versus 5% at present).

Would Congressional approval to allow the FDIC to guarantee all deposits solve the banking problem?

We feel that's a necessary, but not necessarily sufficient, condition to address the banking crisis. Deposit safety and confidence in banks will certainly improve market sentiment. However, the stress on a bank’s income statement from higher short-term rates will still exist, whether or not the bank’s deposits are insured.

Why would depositors keep more than small amounts of cash at a bank earning 0.5%, when they can earn 4% more buying Treasury MMFs? As previously discussed, banks are going to have to pay more to keep their deposits or replace them with financing from the Fed at market-rates. Guaranteeing deposits might stabilize the movement of deposits, but not necessarily the cost of those deposits.

Furthermore, there might be unintended consequences of guaranteeing all deposits. At present, the largest, systemically important banks (JPMorgan, Bank of America, Wells Fargo, and Citibank) are benefiting from their perceived “too big to fail status” and attracting low-cost deposits, because of that perception of safety. That clearly benefits their business model and net interest margin. Cheap deposits certainly allowed JPM to purchase First Republic.

If there was no difference in the safety of a deposit at a large bank, regional bank, or small bank, could the largest banks continue to pay next-to-nothing on their deposits? What would be the impact of shrinking net interest margins at the largest banks in the country? How much would the strain on the banking sector shift from regionals towards large banks? We raise these questions without knowing the answers, only to highlight that an unlimited FDIC guarantee may not be the cure-all that regulators would want, primarily due to the current level of short-term interest rates.

May 3rd FOMC Meeting

The Federal Reserve’s FOMC meeting on May 3rd would have normally been the biggest news of the month. As expected, the Federal Reserve raised overnight interest rates 0.25% to 5.25% (a full 5% increase in 14 months). Federal Reserve Chairman Jerome Powell indicated that “we are prepared to do more if greater monetary policy restraint is warranted.”

The interest-rate markets expect the Federal Reserve to cut interest rates by the end of the year, while Powell spoke about possibly raising (and certainly, not cutting) rates, if needed, to keep fighting inflation. Powell also stated at the beginning of his press conference that “conditions in that [the banking] sector have broadly improved since early March, and the U.S banking system is sound and resilient.” That statement seems to be a bit puzzling, two days after the second largest bank failure in U.S. history.

Clearly, the Fed has its hands full: trying to fight inflation, for which high interest rates are certainly part of the economic cure, and trying to keep the banking system sound. The cure for inflation (the rapid increase in short-term and long-term interest rates) has greatly impacted the banking system’s financial health.

Unfortunately, the Federal Reserve over the last two years has proven itself to be late, wrong, and stubborn in its course of action on rate increases and bond buying, even when changes have been obviously warranted.

The Federal Reserve was calling inflation transitory in the fall of 2021 – even as inflation was hitting 30-year highs – and continued to purchase bonds to keep long-term interest rates low until March of 2022, when it raised interest rates for the first time. In September 2021, the FOMC was predicting a year-end 2023 Federal Funds rate of 0.25%, and a year-end 2024 Federal Funds rate of 1.00%.

Given the Federal Reserve’s recent history of following through on what it says it will do and when it will do it before changing course, it’s reasonable to assume that they will keep rates “higher for longer” as they state, unless and until there’s a major crisis in the banking system or economy.

Debt ceiling discussions

Buried in the other recent headlines is Treasury Secretary Janet Yellen’s statement on Monday, May 1st , that the U.S. Treasury could run out of money to pay its bills as early as June 1, if Congress and the President cannot agree on a bill to raise the U.S. debt limit. This date is earlier than markets had been expecting and is likely based on both April tax receipt data and partially a negotiating tactic on the administration’s part.

At this point, it’s hard to know how and when this issue will be resolved. Our assumption is that it will be resolved; however, as Winston Churchill observed: “Americans will always do the right thing, only after they have tried everything else.” To the extent that delays in these negotiations lead to unexpected issues or opportunities in the bond or stock markets, we will adopt the appropriate steps to safeguard portfolios or look to take advantage of opportunities that may present themselves.

Protecting our clients’ cash

The current banking crisis is a serious situation and an echo (not necessarily a repeat) of the 2008 financial crisis. Earlier in this piece, we used the analogy of a major financial earthquake hitting the San Francisco Bay Area in March. We have just seen another aftershock (First Republic), but do not yet know how many or how severe future ones may be. We may be seeing PacWest Bank having its own problems, as we write this piece.

It is important to separate one’s long-term holdings from one’s near-term cash needs. It is always better to keep slightly more cash than you might think – so that you can live your life, handle an unexpected expense, or make an attractive investment, if it should arise.

Farther has a strong playbook for managing client cash – which I learned during my tenure as an advisor at Goldman Sachs amidst the 2008 financial crisis – to keep your cash as safe as possible.

Here are a few basic steps to understand and take:

- Bank deposits are insured up to $250,000 per depositor per bank per ownership category. Anything over that is at risk of loss if the FDIC closes a bank.

- Move your excess cash into U.S. Treasury Money Market Funds, U.S. Treasury Bills, or ETFs that own US Treasury Bills. Do not stretch for small amounts of yield in other types of MMFs in your cash portfolio.

- In 2008, yields on U.S. T-bills went negative during the post-Lehman Brothers panic. Today, they yield approximately 5%. Most banks are paying considerably less than the Treasury is at the moment.

In the current environment: being safe with your excess cash generally improves the return on your cash, versus keeping it in a bank account!

If you have questions about what to do with cash you hold away for your personal or business account, please connect with your Farther advisor to discuss your options.

It is difficult to predict what the stock and bond markets will do in the short term. U.S. stocks are slightly expensive relative to history, international stocks are cheap relative to history, and bond yields are attractive after last year’s terrible performance. In the near term, markets may well be volatile, as the banking crisis continues and debt ceiling discussions take center stage. We recommend staying invested in your long-term portfolio.

We are prepared to rebalance to take advantage of any dramatic opportunities that may present themselves in the public or private markets, whether from the banking crisis or the debt ceiling negotiations.